About Us

If your company is in business to help families attain the American Dream through housing finance, then working with Mortgage Capital Management (MCM) may be a significant part of your solution. We provide the vital tools needed to ensure that you do so profitably in all market conditions. From pricing, hedging, trading, best execution, and servicing valuation we have had the secondary market covered since 1994. We provide your competitive advantage using state of the art tools delivered on a customized basis so you can focus on helping families attain their dream.

MCM provides its services through online technology in three different formats: software as a service, software in the cloud, or Self-Hosted environments. This provides an unlimited ability to deliver our services and technology to Clients and creates the opportunity to match each Client’s needs with a solution set designed to exceed their expectations.

Some of our

tools, enhanced

hedging

strategies,

and systems

include:

- Advanced Position Reporting, Updates, and Scenario Analysis

- Value At Risk (VAR) Hedge Optimization

- OAS Hedge Ratio & Servicing Valuation & Analysis

- Total Sale Optimization / Best Execution Based Mark to Market and Analytics

- Forward Builder Commitment & Float Down Pricing & Hedging

- Unique Trading Analysis – Diffusion Analysis

- Automated (execution-based) Base Pricing tool

- Client Risk Position Historical Database

One part of our business formula that we believe sets MCM apart from the pack is the coaching aspect of how we do business. It is our belief that if we empower our clients to be experts in the secondary marketing area, they will be better at what they do and their profitability will improve. This increased capability will also allow them to be more competitive over time, thereby helping more families.

MCM provides its services through two types of relationships: Guardian and Partnership. The Guardian relationship provides companies with full-service secondary marketing services, including position management and trading. The Partnership account provides full access to systems, analytics, reporting and is self-managed.

Mortgage Capital Management was founded to help mortgage bankers become consistently profitable through the use of best-in-class pipeline risk management tools and strategies in the mortgage industry. Our proven pipeline risk management services, secondary marketing consulting/coaching, and hedging/trading services help Clients remain profitable despite volatile markets and changing interest rates. By combining proprietary, state of the art technology with personalized Client service, that includes counsel from senior advisors, we can mitigate client interest rate risk, maximize their earnings, and improve operational efficiencies so they can focus on what really matters – The American Dream!

Call us to today to learn more or schedule an online demo

Project & Services

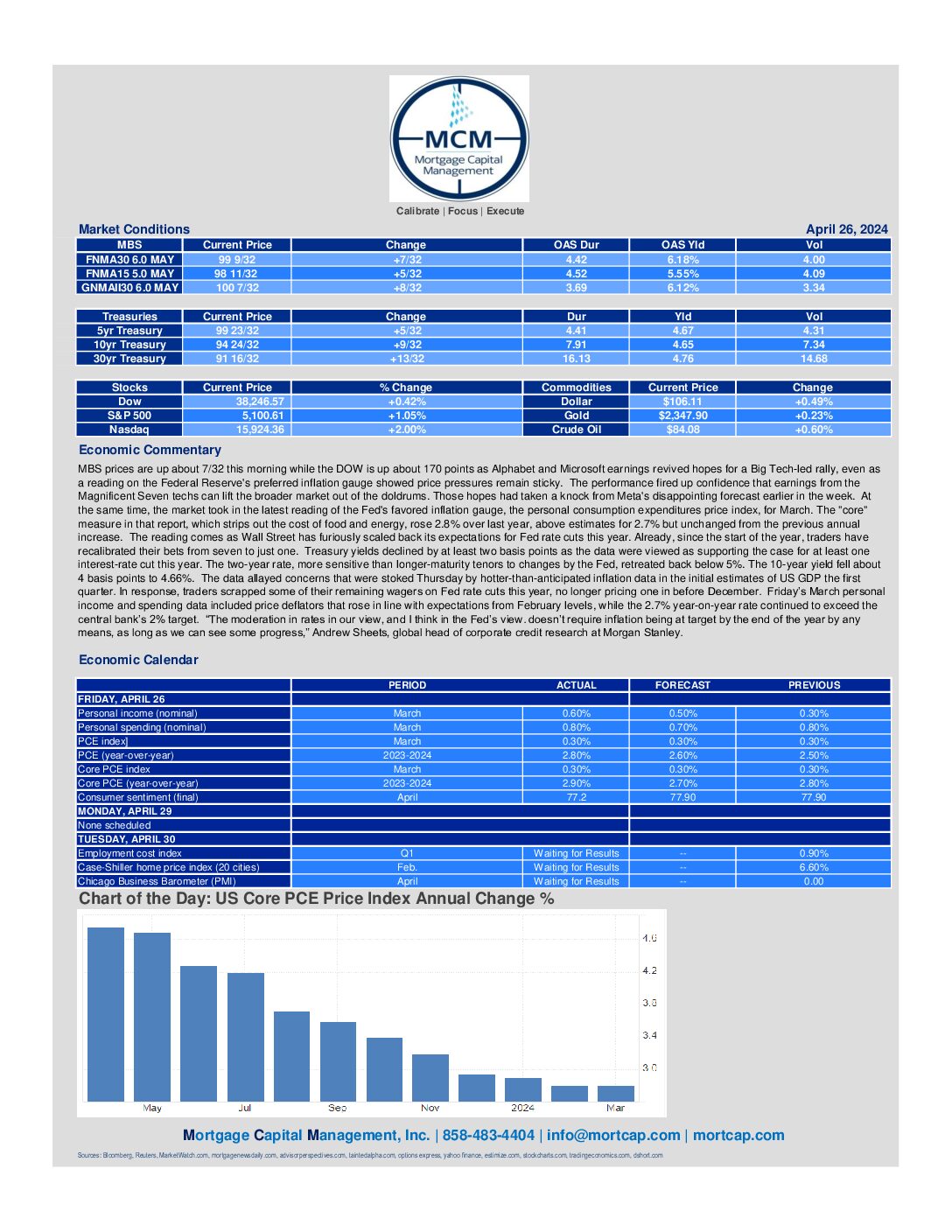

April 26th Market Commentary

MBS prices are up about 7/32 this morning while the DOW is up about 170 points as Alphabet and Microsoft earnings revived hopes for a Big Tech-led rally, even as a reading on the Federal Reserve's preferred inflation gauge showed price pressures remain sticky. Treasury yields declined by

April 24th Market Commentary

MBS prices are down about 7/32 this morning while the DOW is down about 130 points as the ten year treasury yield rose 1.17% to 4.65. Mortgage applications in the US fell by 2.7% from the previous week in the period ending April 19th, trimming the 3.3% increase

April 23rd Market Commentary

MBS prices are up about 5/32 this morning while the DOW is up about 265 points as treasury yields are modestly lower to start the day, with the 10-year yield ticking down to around 4.59%, while the 2-year yield is hovering just below the 5% mark. Today's economic reports showed

April 22nd Market Commentary

MBS prices are up about 3/32 this morning while the DOW is up about 140 points as investors braced for a flood of corporate earnings. After its recent battering, the market rally has sunk to its most fragile point in months, and this week will be critical to determining

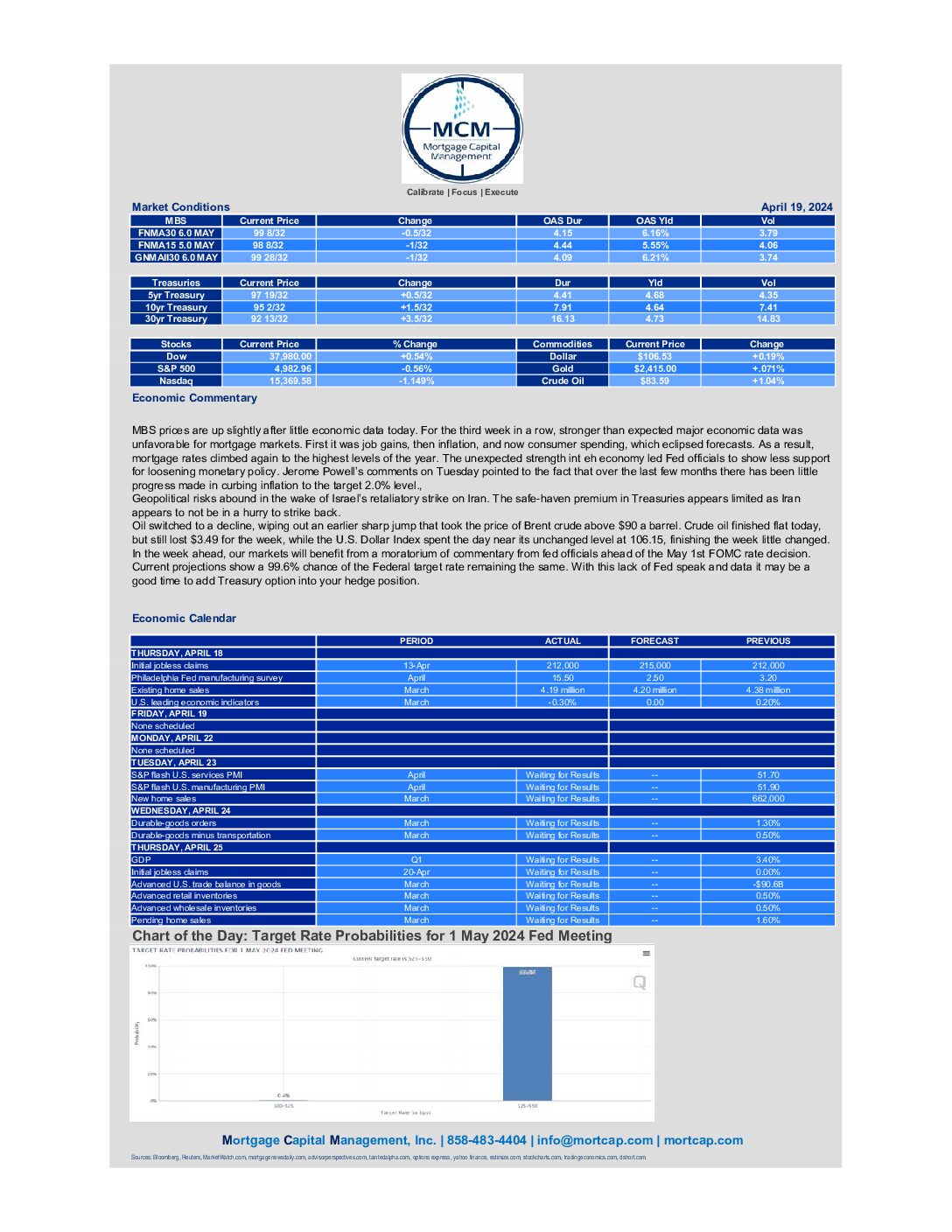

April 19th Market Commentary

MBS prices are up slightly after little economic data today. For the third week in a row, stronger than expected major economic data was unfavorable for mortgage markets. First it was job gains, then inflation, and now consumer spending, which eclipsed forecasts. As a result, mortgage rates climbed again to the highest

April 18th Market Commentary

MBS prices are down about 9/32 this morning while the DOW is down about 15 points as investors braced for Netflix to kick earnings season into high gear. Stocks have struggled amid concerns inflation is no longer cooling and the Federal Reserve could ease back on interest rate cuts.

April 17th Market Commentary

MBS prices are up about 9/32 this morning while the DOW is down about 100 points as investors interest rate worries coincide with a fresh slate of corporate earnings. Stocks have struggled to reprise their early-year rally, buffeted most recently by worries over heightened tensions in the Middle East

April 16th Market Commentary

MBS prices are down about 6/32 this morning while the DOW is up about 200 points. The moves come as bond yields remain at multi-month highs, coupled with rising tensions in the Middle East following Iran's weekend attacks on Israel. After the 10-year Treasury yield touched 2024 highs

April 15th Market Commentary

MBS prices are down about 13/32 this morning while the DOW is up about 160 points as yields on benchmark U.S. 10-year Treasuries jumped to their highest level since November on Monday after stronger-than-expected retail sales data from March suggested the Federal Reserve could delay cutting interest rates this year.

April 12th Market Commentary

MBS prices are up about 7/32 this morning while the DOW is down about 385 points as techs lost their winning ways, and as investors reeled from the banking sector's mixed results to kick off earnings season. Investors are scrutinizing quarterly results from Wall Street's big banks to assess