Enterprise Risk Management

Hedging against risk can be a complex undertaking for the mortgage lender or servicer. When performed well, it protects the institution against various forms of risk. When performed poorly, it costs too much and provides substandard protection from market shifts. MCM’s Enterprise Risk Management offering provides effective risk management for both the lender’s origination pipeline and servicing portfolio.

Many diversified financial institutions face complex calculations when attempting to maximize the return on their various assets. MCM offers the analytical tools and the experience to make this process manageable. This is particularly important for originators who also maintain servicing portfolios.

Our Enterprise Risk Management offering provides the support these institutions need to maximize their balance sheet and protect the institution as a whole from the various risks inherent in the market.

Many servicers find that it is much more efficient to hedge both their servicing portfolios and their origination pipelines together. Separating these assets increases risk and makes it very difficult to formulate a strategy that is cost efficient. By considering them together, these lenders can create a servicing hedge from the pipeline and use that piece as a synthetic option to hedge their servicing position.

Naturally, this is not the kind of calculation that can be done on a spreadsheet. It takes the kind of sophisticated analytical software MCM has developed and perfected over the past 20 years.

While this offering seems completely logical to executives, this capability to hedge servicing portfolio risk in conjunction with the mortgage pipeline interest rate risk really didn’t exist before MCM developed it. It’s a more efficient way of hedging the servicing portfolio.

This approach will actually allow a lender to hedge 100% of their servicing portfolio. Traditionally, servicers have only hedged a portion of their portfolios. But with MCM, the servicer can have a custom hedge level and change it when they need to, for instance, when a market rally increases the risk of portfolio runoff.

Hedging both sides of the lender’s business together is better than simply using pipeline growth as a servicing hedge, especially when rates are rising and growth becomes much harder to achieve.

More lending institutions are taking this enterprise-wide approach to hedging against risk because it makes it easier to respond to changes in the market and can reduce the time and work it takes to alter the strategy in the face of market changes.

Executives working in this industry know that market shifts often occur abruptly. Markets can rally in hours on the basis of an announcement by the Fed or a major investor. On the other hand, rising rates can stifle pipeline growth, leading to fallout and issues with secondary market investors. By keeping tabs on both sides of the house, lenders are better protected from market shocks.

MCM uses its advanced software and years of experience hedging origination pipeline risk combined with its servicing asset valuation expertise to provide enterprise-wide protection for its clients. We know the appropriate shock values to apply and what to expect when the market rallies or sells off. Our experience allows us to counteract any unexpected valuation change the institution may experience.

This service is often purchased as a stand-alone offering, but MCM also provides this service to clients working with us through either type of standard relationship:

Partnership Account

MCM advises clients, who then execute trades, best execution based pooling and delivery. MCM is always available for conference calls to discuss trading strategies and to provide consulting and market analysis.

Guardian Account

MCM does it all, executing MBS trades, providing best execution based pooling and delivery, monitoring pricing and leading a daily client conference call to coordinate secondary marketing activities.

Under either type of business relationship, MCM’s systems, reporting and analysis tools are all available online providing instant accessibility to comprehensive analysis and reports, eliminating the need for the client to load, maintain and manage the software.

Ease of access, ease of use, quick report generation and real‑time “what‑if” scenarios all provide the client with the necessary tools to succeed in the world of risk management. Combined with MCM’s experienced advisors, Hedge Commander allows clients to grow and prosper in any market environment.

Since 1994, Mortgage Capital Management has helped mortgage bankers of every size become more profitable through the use of best-in-class pipeline risk management tools and strategiesy. Our pipeline risk management services, secondary marketing consulting, and hedging/trading services enable clients to prosper in any market environment.

For nearly 30 years, the U.S. mortgage industry has called upon Mortgage Capital Management for expert advice and proven technologies all designed to deliver best execution in service to a more profitable enterprise. Our customer list includes some of the most successful firms in the business.

Viewing the online demo costs you nothing and will shed light on a unique approach to secondary marketing success that you won’t find anywhere else. Don’t settle for mediocre when excellence is achievable.

Get the MCM Competitive Advantage! Call us to today to learn more or schedule an online demo: 858.483.4404 x220

Call us to today to learn more or schedule an online demo

Project & Services

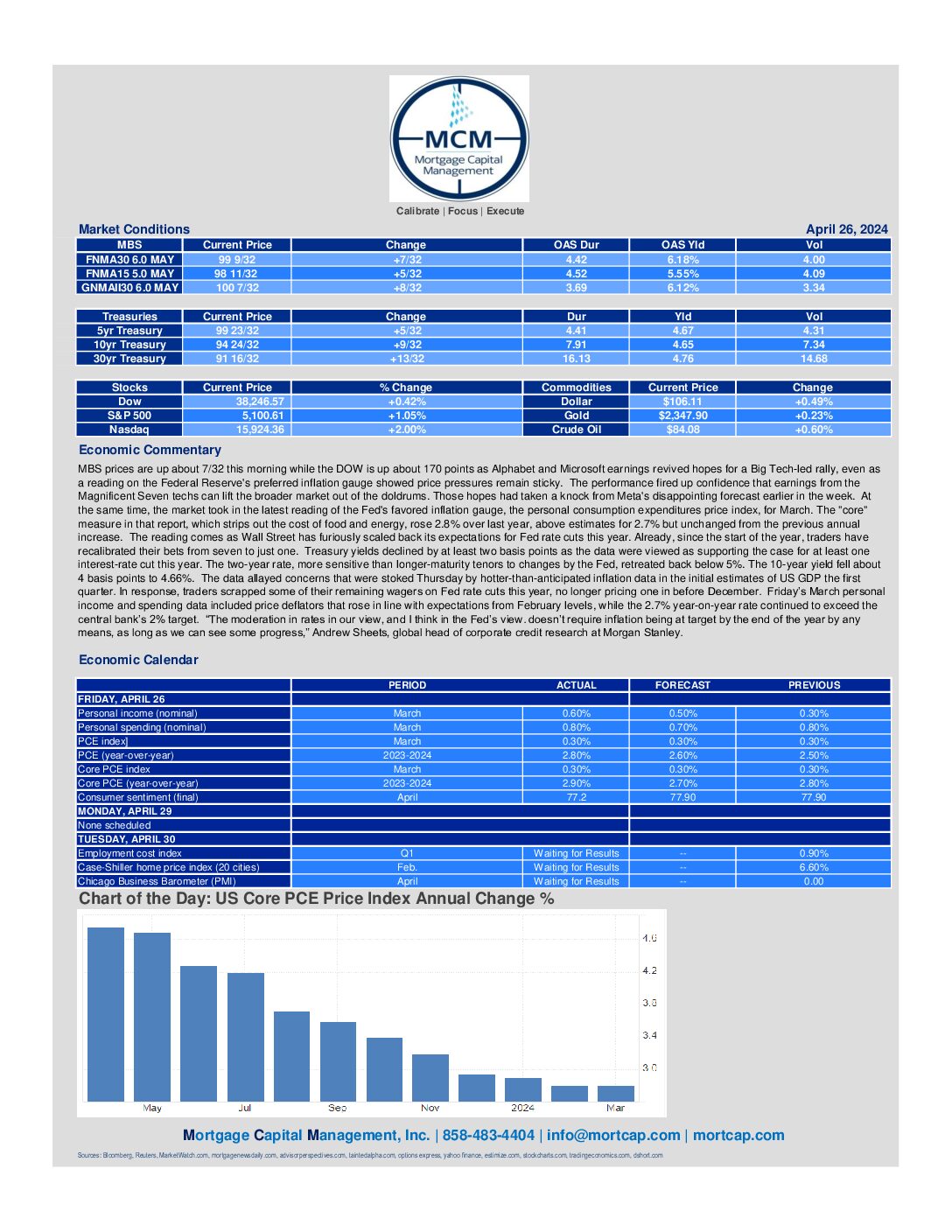

April 26th Market Commentary

MBS prices are up about 7/32 this morning while the DOW is up about 170 points as Alphabet and Microsoft earnings revived hopes for a Big Tech-led rally, even as a reading on the Federal Reserve's preferred inflation gauge showed price pressures remain sticky. Treasury yields declined by

April 24th Market Commentary

MBS prices are down about 7/32 this morning while the DOW is down about 130 points as the ten year treasury yield rose 1.17% to 4.65. Mortgage applications in the US fell by 2.7% from the previous week in the period ending April 19th, trimming the 3.3% increase

April 23rd Market Commentary

MBS prices are up about 5/32 this morning while the DOW is up about 265 points as treasury yields are modestly lower to start the day, with the 10-year yield ticking down to around 4.59%, while the 2-year yield is hovering just below the 5% mark. Today's economic reports showed

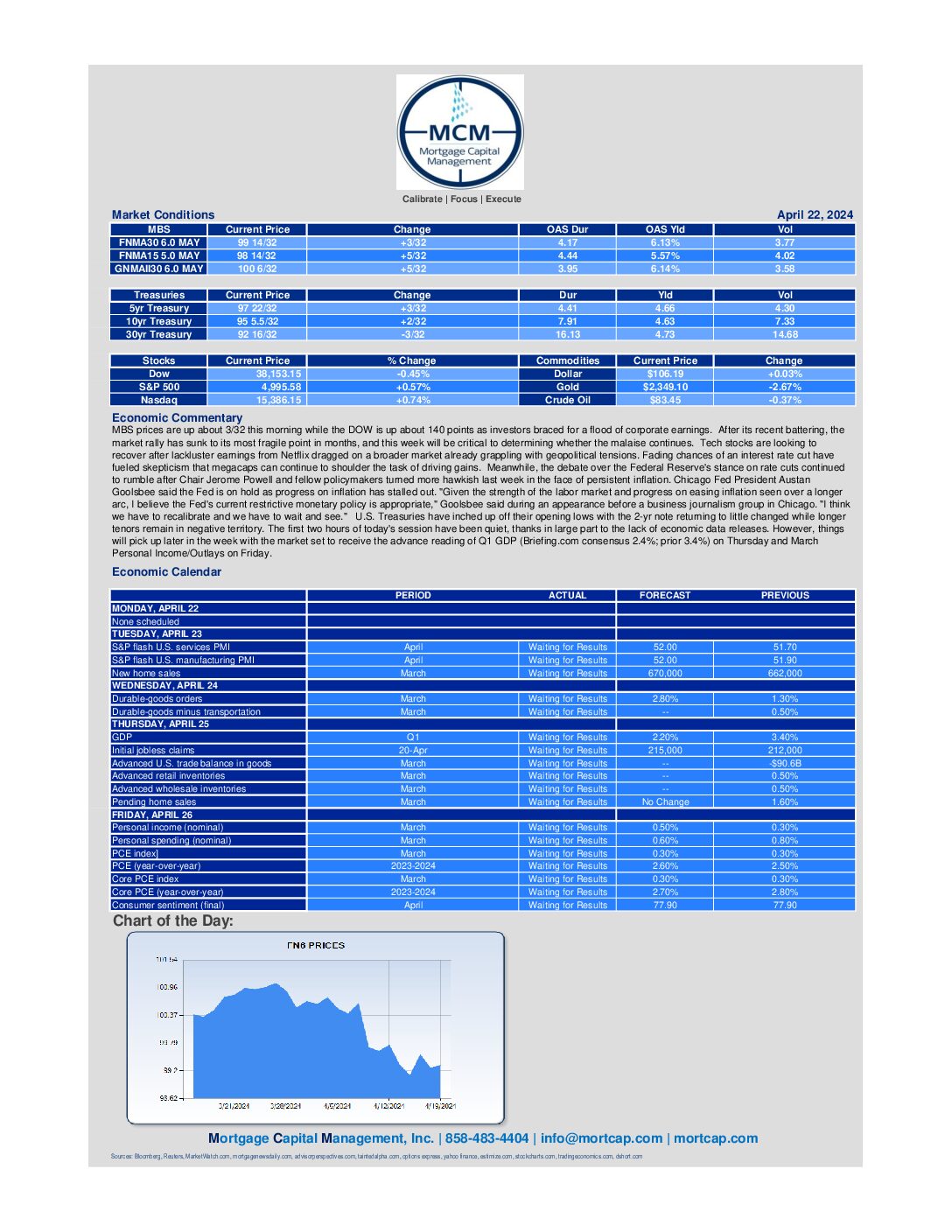

April 22nd Market Commentary

MBS prices are up about 3/32 this morning while the DOW is up about 140 points as investors braced for a flood of corporate earnings. After its recent battering, the market rally has sunk to its most fragile point in months, and this week will be critical to determining

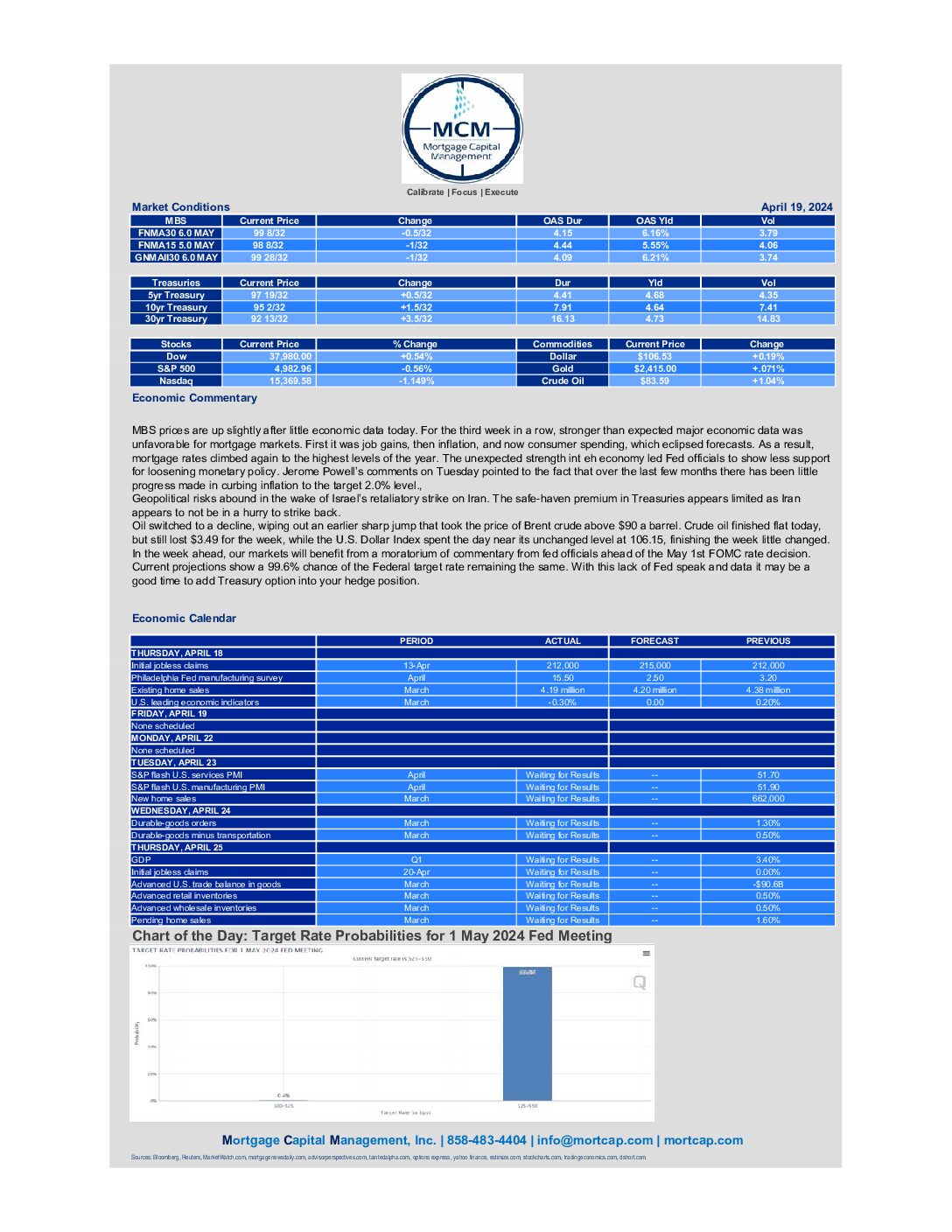

April 19th Market Commentary

MBS prices are up slightly after little economic data today. For the third week in a row, stronger than expected major economic data was unfavorable for mortgage markets. First it was job gains, then inflation, and now consumer spending, which eclipsed forecasts. As a result, mortgage rates climbed again to the highest

April 18th Market Commentary

MBS prices are down about 9/32 this morning while the DOW is down about 15 points as investors braced for Netflix to kick earnings season into high gear. Stocks have struggled amid concerns inflation is no longer cooling and the Federal Reserve could ease back on interest rate cuts.

April 17th Market Commentary

MBS prices are up about 9/32 this morning while the DOW is down about 100 points as investors interest rate worries coincide with a fresh slate of corporate earnings. Stocks have struggled to reprise their early-year rally, buffeted most recently by worries over heightened tensions in the Middle East

April 16th Market Commentary

MBS prices are down about 6/32 this morning while the DOW is up about 200 points. The moves come as bond yields remain at multi-month highs, coupled with rising tensions in the Middle East following Iran's weekend attacks on Israel. After the 10-year Treasury yield touched 2024 highs

April 15th Market Commentary

MBS prices are down about 13/32 this morning while the DOW is up about 160 points as yields on benchmark U.S. 10-year Treasuries jumped to their highest level since November on Monday after stronger-than-expected retail sales data from March suggested the Federal Reserve could delay cutting interest rates this year.

April 12th Market Commentary

MBS prices are up about 7/32 this morning while the DOW is down about 385 points as techs lost their winning ways, and as investors reeled from the banking sector's mixed results to kick off earnings season. Investors are scrutinizing quarterly results from Wall Street's big banks to assess