Forward Builder Commitment

Forward builder commitment is very similar to our float down lock offering, but instead of providing spot commitments for the options required to lock a long rate on a single home, we allow a builder to provide rate lock assurance for an entire development.

This is an offering we pioneered and have been offering the industry since the 1980s. It was developed when our principal was working for a family real estate development business in Southern California. Interest rates were on the rise and homes were becoming less affordable by the time the construction was complete.

The innovation came in the form of the Float Down Lock for a one-time close on new construction. The offering provides assurance to the buyer that they’ll be able to afford the financing when the home is complete. Our Forward Builder Commitment makes this product available for a group of homes under construction.

Here is an example of how this product is used: A developer breaks ground on a $300 million project and expects about half of the homes to be financed through its own captive mortgage company while the other half will be financed by large, national lenders. The developer has the ability to buy an option to hold rates to a certain level for the homes it plans to finance.

This is a much better option than just paying to buy down the rate because some investors, including the GSEs, have limitations on the resulting loan to value for the loans they buy. It’s far better to use a forward builder commitment to purchase an option and then hedge against it to mitigate any risk caused by rate volatility.

Like our popular float down locks, if the rates fall or don’t rise to the cap, the lower rate can be offered to the home buyer. Even if the rate goes higher, the borrower will pay only to the cap rate.

From a marketing perspective, this is a fantastic tool for construction lending as it offers buyers in a volatile market the assurance that they can afford the home under construction. We often refer to it as the builder’s rate protection plan. MCM helps lenders price the commitments and then hedge them appropriately during the timeframe in question.

In a market where mortgage interest rates are rising, offering new home buyers the security that comes with knowing what their financing will cost will save deals and help builders grow.

While builders see great value in this offering, it’s not something most companies can offer. MCM’s experience allows us to price the commitments properly and then hedge them correctly. One mistake we often see is a lender attempting to hedge the risk in $10 million worth of float down locks on a development by selling an equal amount for the DBA. If the market sells off, the lender will be successful, but if it rallies the lender will have too much TBA coverage. The loans will fall out.

When lenders see this happening, they will correct their hedging strategy, but in a volatile market they end up getting whipsawed back and forth, losing money on every trade. It’s far better to just buy an option to hedge based on good market intelligence, which MCM provides.

This service is often purchased as a stand-alone offering, but MCM also provides this service to clients working with us through either type of standard relationship:

Partnership Account

MCM advises clients, who then execute trades, best execution based pooling and delivery. MCM is always available for conference calls to discuss trading strategies and to provide consulting and market analysis.

Guardian Account

MCM does it all, executing MBS trades, providing best execution based pooling and delivery, monitoring pricing and leading a daily client conference call to coordinate secondary marketing activities.

Under either type of business relationship, MCM’s systems, reporting and analysis tools are all available online providing instant accessibility to comprehensive analysis and reports, eliminating the need for the client to load, maintain and manage the software.

Ease of access, ease of use, quick report generation and real‑time “what‑if” scenarios all provide the client with the necessary tools to succeed in the world of risk management. Combined with MCM’s experienced advisors, Hedge Commander allows clients to grow and prosper in any market environment.

Since 1994, Mortgage Capital Management has helped mortgage bankers of every size become more profitable through the use of best-in-class pipeline risk management tools and strategiesy. Our pipeline risk management services, secondary marketing consulting, and hedging/trading services enable clients to prosper in any market environment.

For nearly 30 years, the U.S. mortgage industry has called upon Mortgage Capital Management for expert advice and proven technologies all designed to deliver best execution in service to a more profitable enterprise. Our customer list includes some of the most successful firms in the business.

Viewing the online demo costs you nothing and will shed light on a unique approach to secondary marketing success that you won’t find anywhere else. Don’t settle for mediocre when excellence is achievable.

Get the MCM Competitive Advantage! Call us to today to learn more or schedule an online demo: 858.483.4404 x220

Call us to today to learn more or schedule an online demo

Project & Services

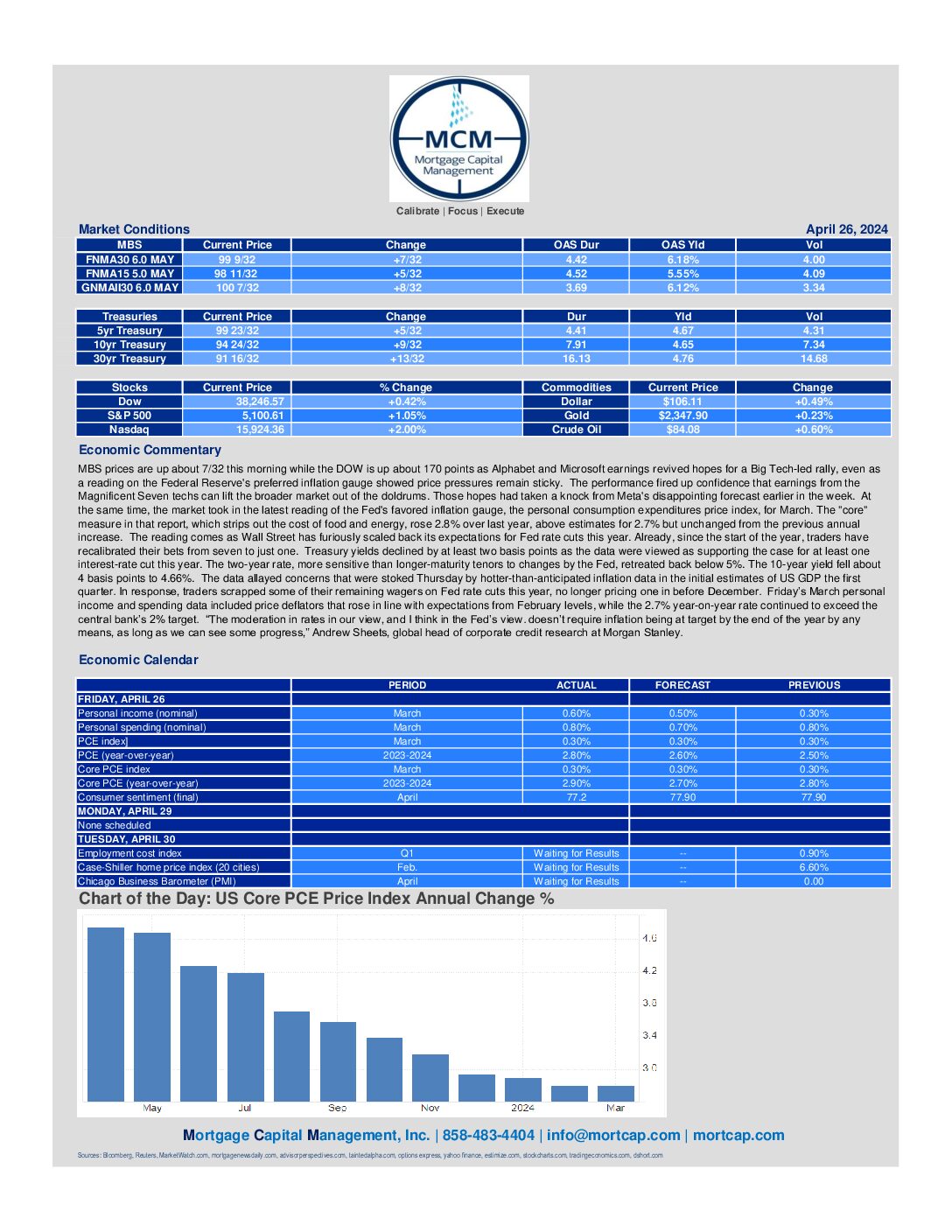

April 26th Market Commentary

MBS prices are up about 7/32 this morning while the DOW is up about 170 points as Alphabet and Microsoft earnings revived hopes for a Big Tech-led rally, even as a reading on the Federal Reserve's preferred inflation gauge showed price pressures remain sticky. Treasury yields declined by

April 24th Market Commentary

MBS prices are down about 7/32 this morning while the DOW is down about 130 points as the ten year treasury yield rose 1.17% to 4.65. Mortgage applications in the US fell by 2.7% from the previous week in the period ending April 19th, trimming the 3.3% increase

April 23rd Market Commentary

MBS prices are up about 5/32 this morning while the DOW is up about 265 points as treasury yields are modestly lower to start the day, with the 10-year yield ticking down to around 4.59%, while the 2-year yield is hovering just below the 5% mark. Today's economic reports showed

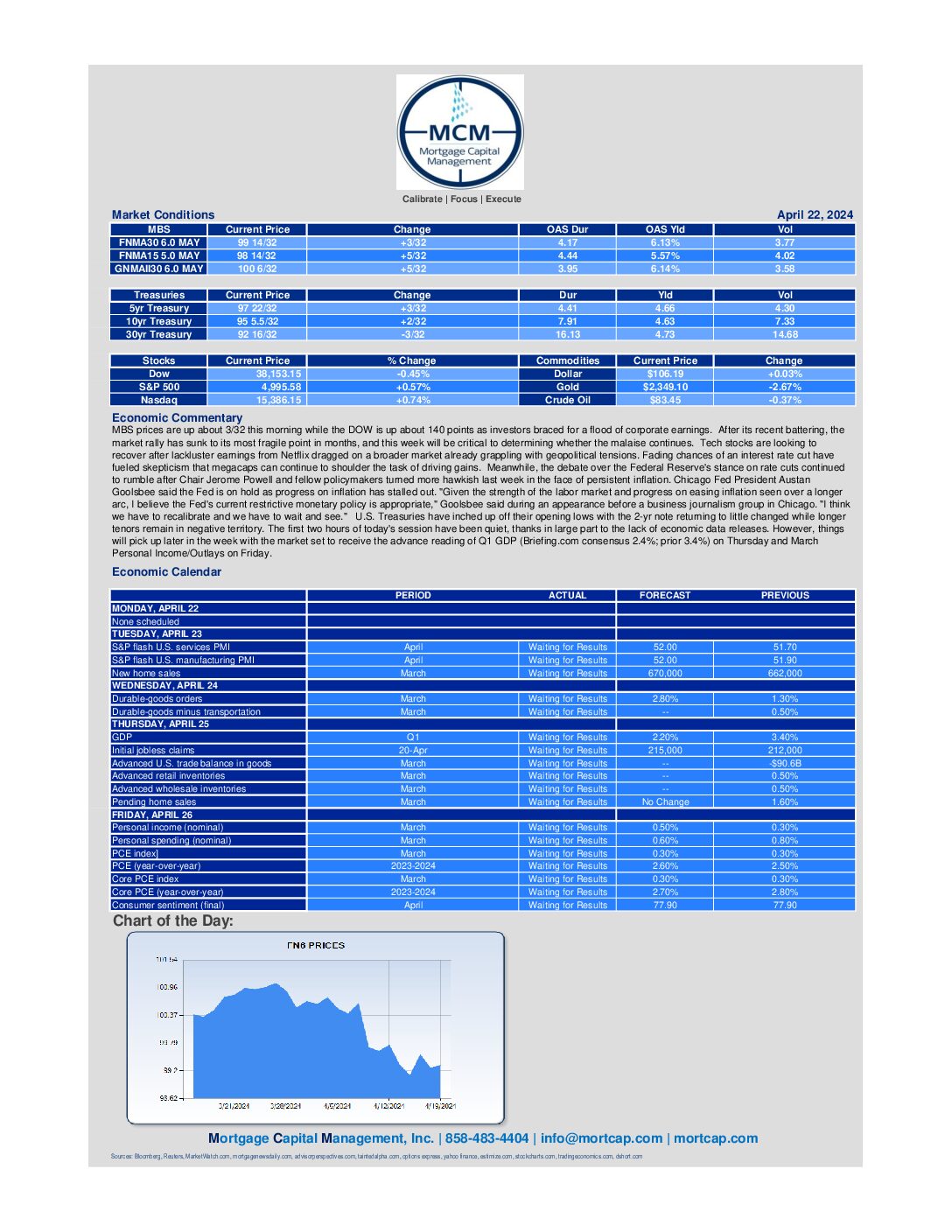

April 22nd Market Commentary

MBS prices are up about 3/32 this morning while the DOW is up about 140 points as investors braced for a flood of corporate earnings. After its recent battering, the market rally has sunk to its most fragile point in months, and this week will be critical to determining

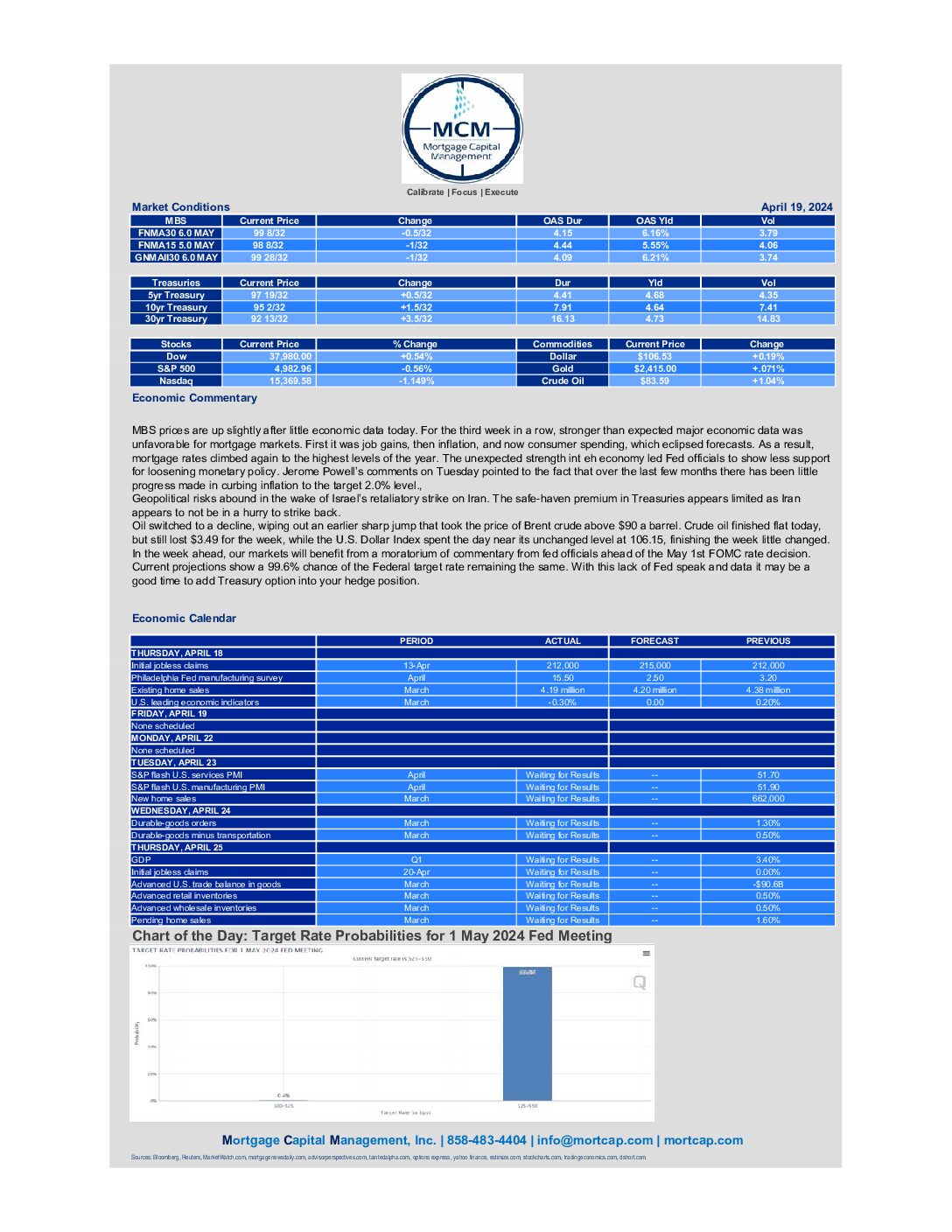

April 19th Market Commentary

MBS prices are up slightly after little economic data today. For the third week in a row, stronger than expected major economic data was unfavorable for mortgage markets. First it was job gains, then inflation, and now consumer spending, which eclipsed forecasts. As a result, mortgage rates climbed again to the highest

April 18th Market Commentary

MBS prices are down about 9/32 this morning while the DOW is down about 15 points as investors braced for Netflix to kick earnings season into high gear. Stocks have struggled amid concerns inflation is no longer cooling and the Federal Reserve could ease back on interest rate cuts.

April 17th Market Commentary

MBS prices are up about 9/32 this morning while the DOW is down about 100 points as investors interest rate worries coincide with a fresh slate of corporate earnings. Stocks have struggled to reprise their early-year rally, buffeted most recently by worries over heightened tensions in the Middle East

April 16th Market Commentary

MBS prices are down about 6/32 this morning while the DOW is up about 200 points. The moves come as bond yields remain at multi-month highs, coupled with rising tensions in the Middle East following Iran's weekend attacks on Israel. After the 10-year Treasury yield touched 2024 highs

April 15th Market Commentary

MBS prices are down about 13/32 this morning while the DOW is up about 160 points as yields on benchmark U.S. 10-year Treasuries jumped to their highest level since November on Monday after stronger-than-expected retail sales data from March suggested the Federal Reserve could delay cutting interest rates this year.

April 12th Market Commentary

MBS prices are up about 7/32 this morning while the DOW is down about 385 points as techs lost their winning ways, and as investors reeled from the banking sector's mixed results to kick off earnings season. Investors are scrutinizing quarterly results from Wall Street's big banks to assess