OAS Servicing Valuations

You cannot achieve best execution for your secondary market trades if you don’t take into account the value of the servicing asset. In some cases, it makes sense to retain these assets. In others, a better outcome can be achieved by selling them off. While very few of our clients come to us only to put a value on these assets, we have done that in the past.

It’s more common for us to provide our valuation expertise as part of a larger engagement. For instance, many of our clients execute trades but retain the servicing. While our primary business has long been providing best execution trades into the secondary market, it’s important for our clients who retain their servicing to know the value of these assets. As a result, we have built a successful business performing Option-Adjusting Pricing for Mortgage Servicing Rights.

This is an important part of the total sale optimization offering that MCM makes available because there are circumstances where it makes sense to sell off the servicing. To make that determination, we have developed an expertise at evaluating these assets.

Unlike most companies that evaluate these assets, we don’t rely on a cash flow model. We use the OAS valuation methodology. This takes into account many factors, including the type of loan, the loan amount, the intent, the purpose, the location, and other factors that can impact the value. We then test these values by performing what-if analysis, shocking interest rates up and down and using the client’s cost of funds and their return requirements as part of the valuation metric.

This method is much more accurate and can be customized to the specifics of the lender, which provides advantages that other methods do not. We don’t just answer the question, “What is the value of the servicing for this loan to the market?” We answer the question, “What is this loan’s servicing worth to you?”

We don’t go into the market in search of similar portfolios to give our clients an estimate of the value in their own portfolio. We actually do a loan level analysis of our clients’ portfolios.

This is a very complex analysis that requires us to know our client’s earnings goal, consider the spread between that amount and that the market is currently offering, factor in the yield curve and consider the duration of the assets. We evaluate every loan in the portfolio individually and then combine the results to value our client’s servicing portfolio.

Our clients have a much better idea of the value of their business and can make better decisions about the execution of future loan production. And when it comes to selling their existing servicing rights, they know exactly what these assets are worth to them, so they never have to settle for selling for less.

When it comes to hedging strategy, having this kind of valuation on their servicing is very valuable, especially in an environment where interest rates are rising and lenders need to hedge long term locks and float down locks.

MCM provides this service to clients working with us through either type of relationship:

Partnership Account

MCM advises clients, who then execute trades, best execution based pooling and delivery. MCM is always available for conference calls to discuss trading strategies and to provide consulting and market analysis.

Guardian Account

MCM does it all, executing MBS trades, providing best execution based pooling and delivery, monitoring pricing and leading a daily client conference call to coordinate secondary marketing activities

Under either type of business relationship, MCM’s systems, reporting and analysis tools are all available online providing instant accessibility to comprehensive analysis and reports, eliminating the need for the client to load, maintain and manage the software.

Ease of access, ease of use, quick report generation and real‑time “what‑if” scenarios all provide the client with the necessary tools to succeed in the world of risk management. Combined with MCM’s experienced advisors, Hedge Commander allows clients to grow and prosper in any market environment.

Since 1994, Mortgage Capital Management has helped mortgage bankers of every size become more profitable through the use of best-in-class pipeline risk management tools and strategies. Our pipeline risk management services, secondary marketing consulting, and hedging/trading services enable clients to prosper in any market environment.

For nearly 30 years, the U.S. mortgage industry has called upon Mortgage Capital Management for expert advice and proven technologies all designed to deliver best execution in service to a more profitable enterprise. Our customer list includes some of the most successful firms in the business.

Viewing the online demo costs you nothing and will shed light on a unique approach to secondary marketing success that you won’t find anywhere else.

We’re also open to discussing your unique requirements to arrive at a workable solution that will help you achieve your unique goals. Once you see what’s possible with modern financial services technology, your successful future will begin to come into focus. Don’t settle for mediocre when excellence is achievable.

Get the MCM Competitive Advantage! Call us to today to learn more or schedule an online demo: 858.483.4404 x220

Call us to today to learn more or schedule an online demo

Project & Services

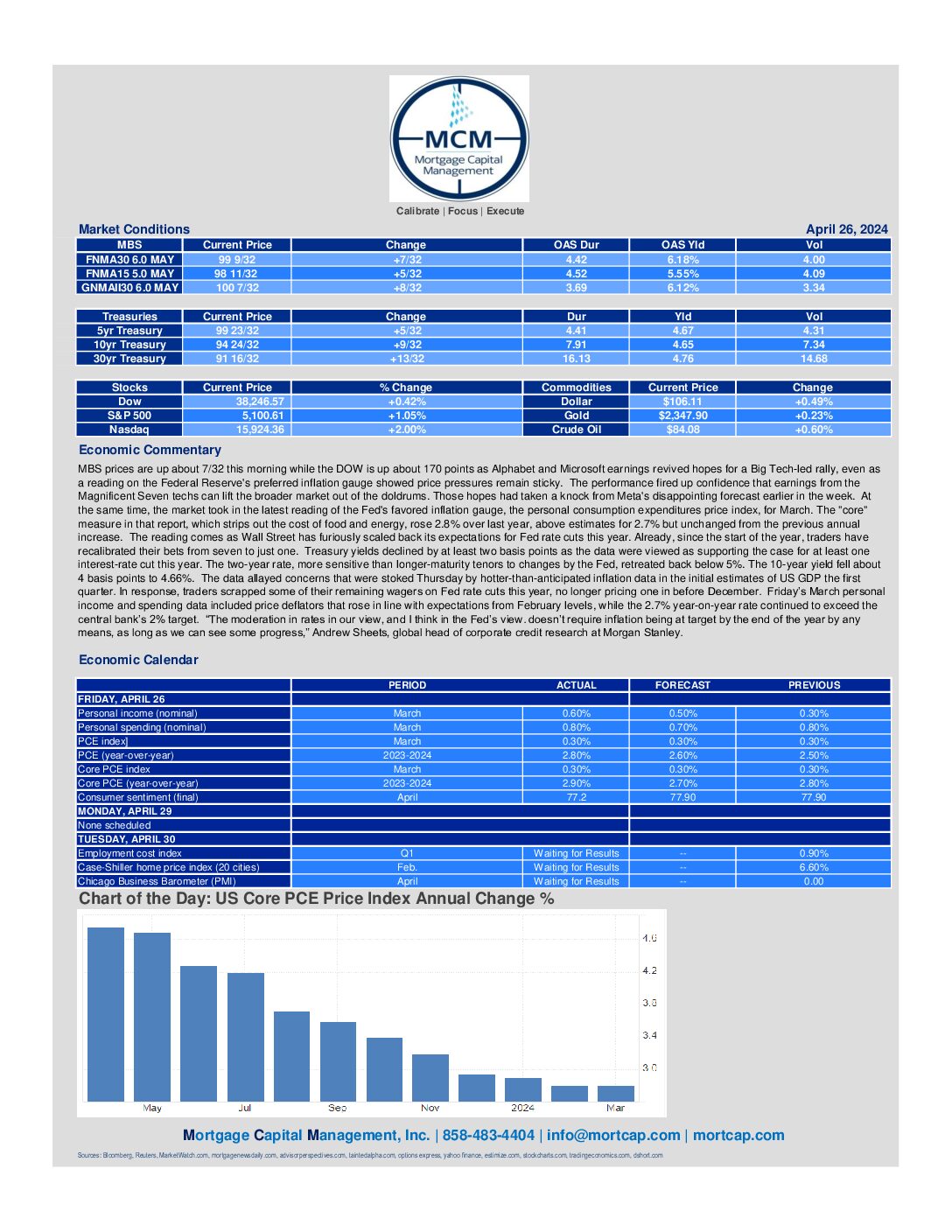

April 26th Market Commentary

MBS prices are up about 7/32 this morning while the DOW is up about 170 points as Alphabet and Microsoft earnings revived hopes for a Big Tech-led rally, even as a reading on the Federal Reserve's preferred inflation gauge showed price pressures remain sticky. Treasury yields declined by

April 24th Market Commentary

MBS prices are down about 7/32 this morning while the DOW is down about 130 points as the ten year treasury yield rose 1.17% to 4.65. Mortgage applications in the US fell by 2.7% from the previous week in the period ending April 19th, trimming the 3.3% increase

April 23rd Market Commentary

MBS prices are up about 5/32 this morning while the DOW is up about 265 points as treasury yields are modestly lower to start the day, with the 10-year yield ticking down to around 4.59%, while the 2-year yield is hovering just below the 5% mark. Today's economic reports showed

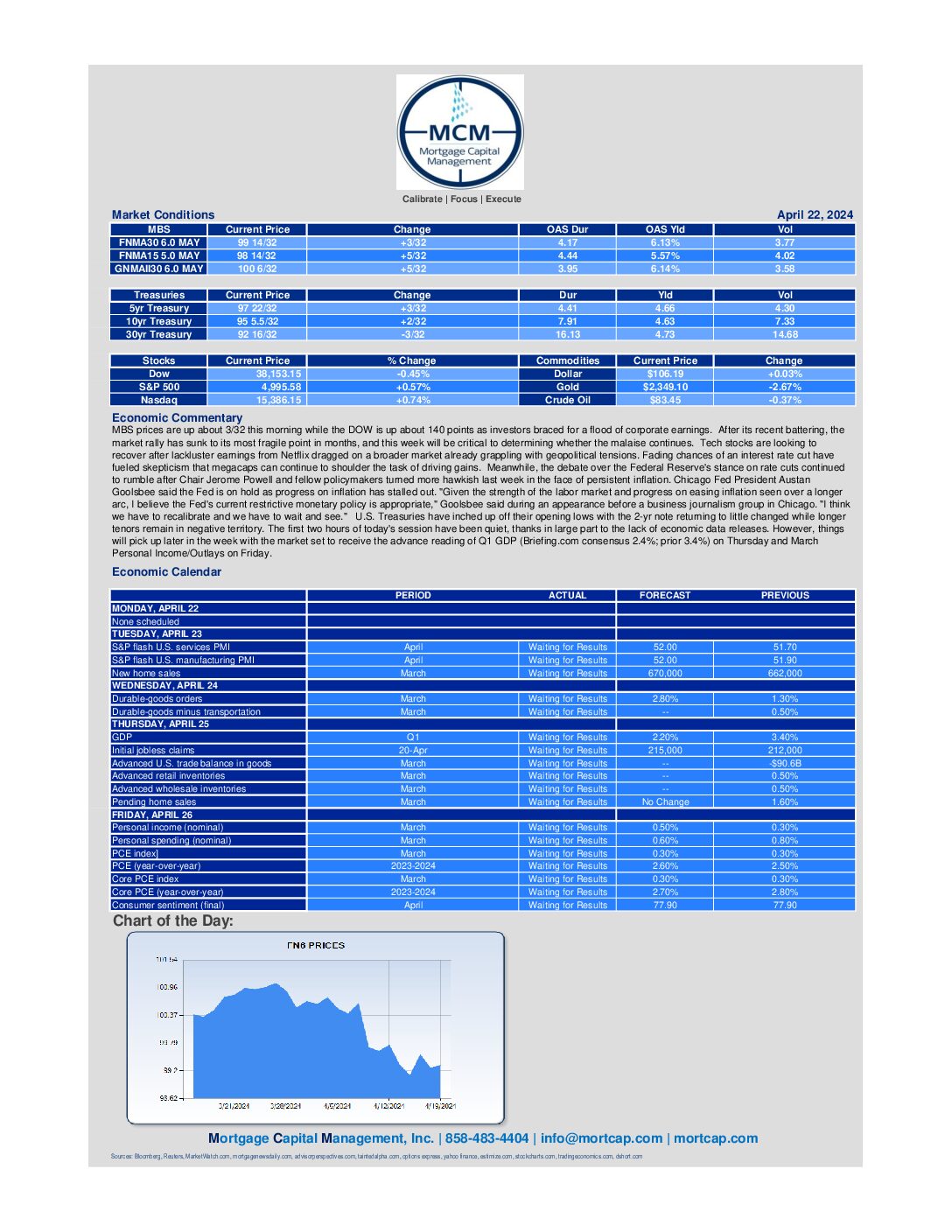

April 22nd Market Commentary

MBS prices are up about 3/32 this morning while the DOW is up about 140 points as investors braced for a flood of corporate earnings. After its recent battering, the market rally has sunk to its most fragile point in months, and this week will be critical to determining

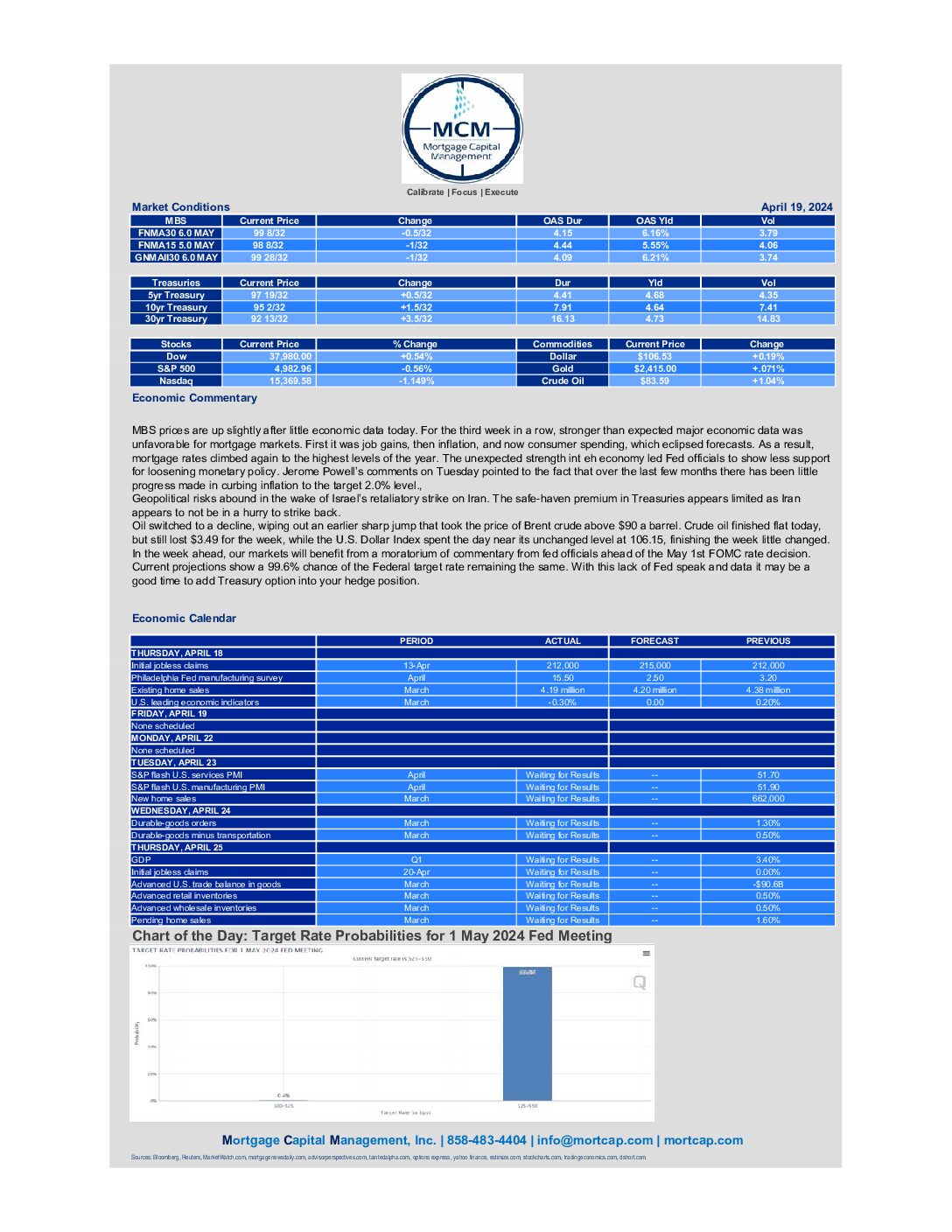

April 19th Market Commentary

MBS prices are up slightly after little economic data today. For the third week in a row, stronger than expected major economic data was unfavorable for mortgage markets. First it was job gains, then inflation, and now consumer spending, which eclipsed forecasts. As a result, mortgage rates climbed again to the highest

April 18th Market Commentary

MBS prices are down about 9/32 this morning while the DOW is down about 15 points as investors braced for Netflix to kick earnings season into high gear. Stocks have struggled amid concerns inflation is no longer cooling and the Federal Reserve could ease back on interest rate cuts.

April 17th Market Commentary

MBS prices are up about 9/32 this morning while the DOW is down about 100 points as investors interest rate worries coincide with a fresh slate of corporate earnings. Stocks have struggled to reprise their early-year rally, buffeted most recently by worries over heightened tensions in the Middle East

April 16th Market Commentary

MBS prices are down about 6/32 this morning while the DOW is up about 200 points. The moves come as bond yields remain at multi-month highs, coupled with rising tensions in the Middle East following Iran's weekend attacks on Israel. After the 10-year Treasury yield touched 2024 highs

April 15th Market Commentary

MBS prices are down about 13/32 this morning while the DOW is up about 160 points as yields on benchmark U.S. 10-year Treasuries jumped to their highest level since November on Monday after stronger-than-expected retail sales data from March suggested the Federal Reserve could delay cutting interest rates this year.

April 12th Market Commentary

MBS prices are up about 7/32 this morning while the DOW is down about 385 points as techs lost their winning ways, and as investors reeled from the banking sector's mixed results to kick off earnings season. Investors are scrutinizing quarterly results from Wall Street's big banks to assess