Hedge Analytics & Advisory

Understand the forces that impact your loan pipeline and hedge against losses.

The primary objective of the secondary marketing department is to deliver loans for sale into the secondary market on a consistently profitable basis. Hence, the trading and hedging activities performed by our clients are designed to minimize the risks associated with the loan origination business while maximizing gain on sale.

The fact is, managing pipeline risk is not a simple task. Is it rocket science? It is if it’s done right.

Mortgage Capital Management has developed a new, distinctively different Pipeline Risk Management paradigm. Our process worked extremely well over the years and especially through the pandemic and is now being applied by lenders of all sizes across the industry.

Our scientific approach to hedge analytics borrows from the option-adjusted spread (OAS) analysis common to large institutions managing portfolios of mortgage-backed assets. It’s a measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to take into account an embedded option.

Embedded options are provisions included with some fixed-income securities that allow the investor or the issuer to do specific actions, such as calling back the issue. Lenders that had options in their hedging strategy prior to the pandemic made out handsomely, while those that did not saw volatile earnings swings.

The analysis can be complex, but the results are impressive for MCM clients. We arrive at our results through the use of a proprietary, cloud based, or secure offsite, server-based Pipeline Risk Management software that offers 24/7 accessibility. No one in the industry comes close to the power we’ve built into our system.

MCM provides our analytics and services through two different types of relationships:

Partnership Account

Clients execute MBS trades, best execution based pooling and delivery, and manage the Pipeline Risk Position; however, MCM is always available for conference calls to discuss trading strategies and to provide consulting and market analysis.

Guardian Account

MCM executes MBS trades, provides best execution based pooling and delivery, monitors pricing and leads a daily conference call to coordinate secondary marketing activities. Under this relationship, we work to train your staff to take over the management responsibility when ready.

In both cases, our services keep pace with our client’s efforts, providing continuous support and advice from expert MCM advisors. Further, our advice is not generic, but rather, it’s tailored to the specific needs of our clients.

From the beginning of each client relationship, MCM immerses itself in our client’s unique circumstances, including management objectives, existing capabilities and pipeline risk. This results in a unique document called the Pipeline Hedging Objective.

The purpose of this document is to outline Sample Client’s mortgage pipeline interest rate risk management process. In addition, this document discusses the various categories of risk inherent in the loan origination business and summarizes the methods used to manage these risks. This approach allows MCM Senior Advisors to pinpoint issues, create goals and work together with the client to create efficiencies.

Risk management service fees are typically based upon a monthly retainer plus a percent of volume – an agreement that automatically allows for changes in market conditions and pipeline variations. The results are excellent mortgage pipeline interest rate risk management and optimized secondary marketing.

Is your firm in need of a distinctively different approach to managing pipeline risk?

To find out if MCM is right for you, give us a call. We will conduct a preliminary analysis of your operations and determine if we can increase your profits and stabilize your earnings. If you are ready to move beyond best efforts execution levels or your existing methods of pipeline risk management need help, and your volume is over $10 million per month, you are likely a great candidate for MCM’s services.

Viewing the online demo costs you nothing and will shed light on a unique approach to secondary marketing success that you won’t find anywhere else. We’re also open to discussing your unique requirements to arrive at a workable solution that will help you achieve your unique goals. Once you see what’s possible with modern financial services technology, your successful future will begin to come into focus. Don’t settle for mediocre when excellence is achievable.

Get the MCM Competitive Advantage! Call us to today to learn more or schedule an online demo: 858.483.4404 x220

Call us to today to learn more or schedule an online demo

Project & Services

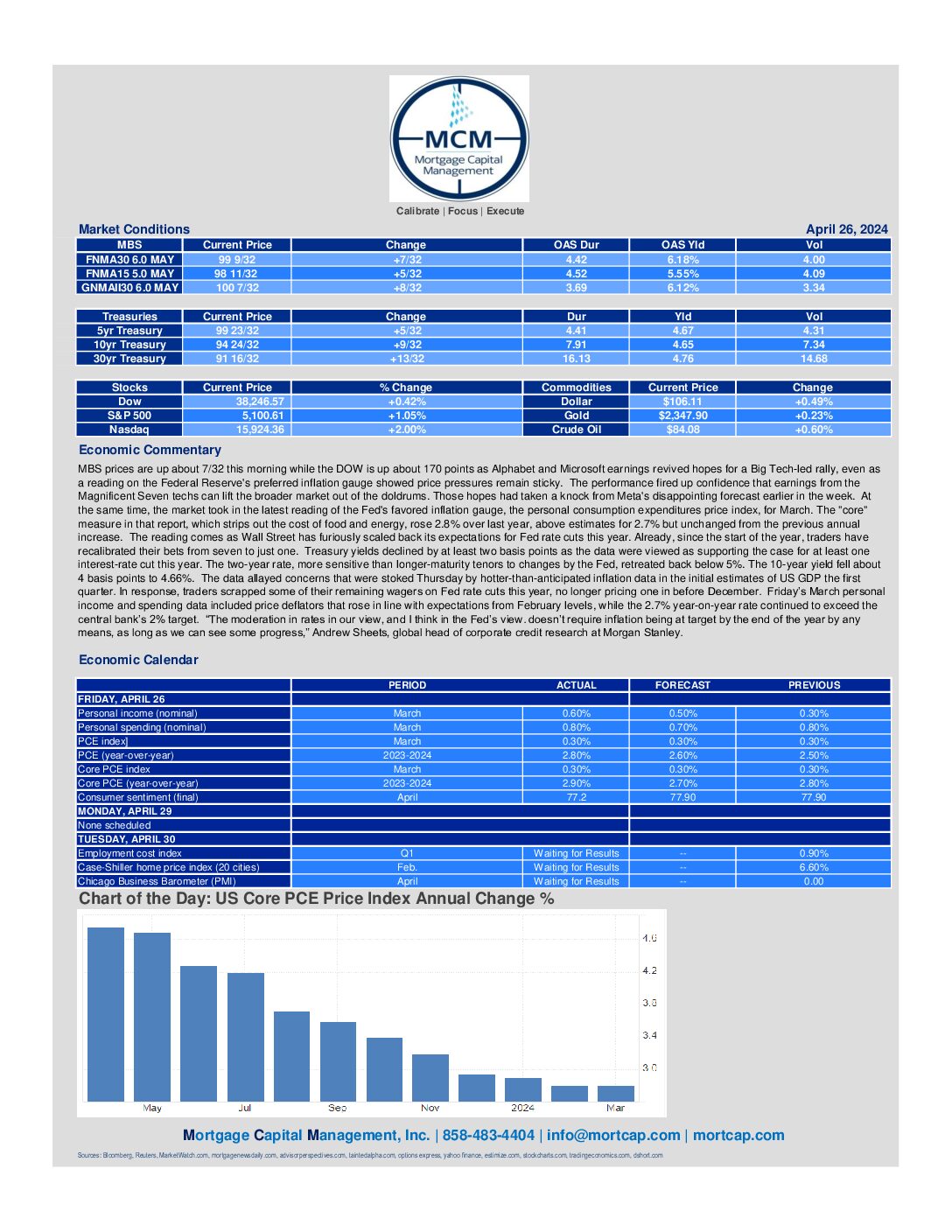

April 26th Market Commentary

MBS prices are up about 7/32 this morning while the DOW is up about 170 points as Alphabet and Microsoft earnings revived hopes for a Big Tech-led rally, even as a reading on the Federal Reserve's preferred inflation gauge showed price pressures remain sticky. Treasury yields declined by

April 24th Market Commentary

MBS prices are down about 7/32 this morning while the DOW is down about 130 points as the ten year treasury yield rose 1.17% to 4.65. Mortgage applications in the US fell by 2.7% from the previous week in the period ending April 19th, trimming the 3.3% increase

April 23rd Market Commentary

MBS prices are up about 5/32 this morning while the DOW is up about 265 points as treasury yields are modestly lower to start the day, with the 10-year yield ticking down to around 4.59%, while the 2-year yield is hovering just below the 5% mark. Today's economic reports showed

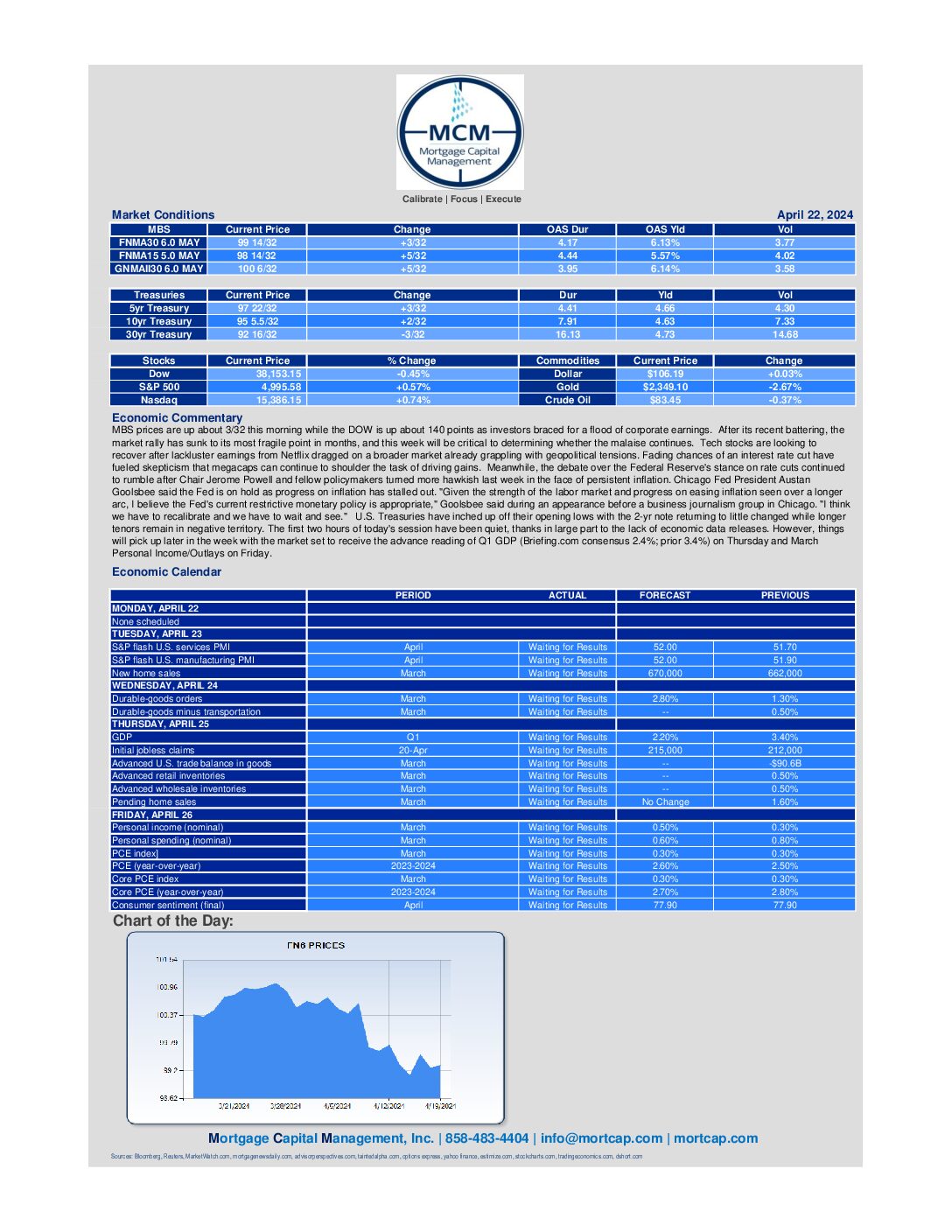

April 22nd Market Commentary

MBS prices are up about 3/32 this morning while the DOW is up about 140 points as investors braced for a flood of corporate earnings. After its recent battering, the market rally has sunk to its most fragile point in months, and this week will be critical to determining

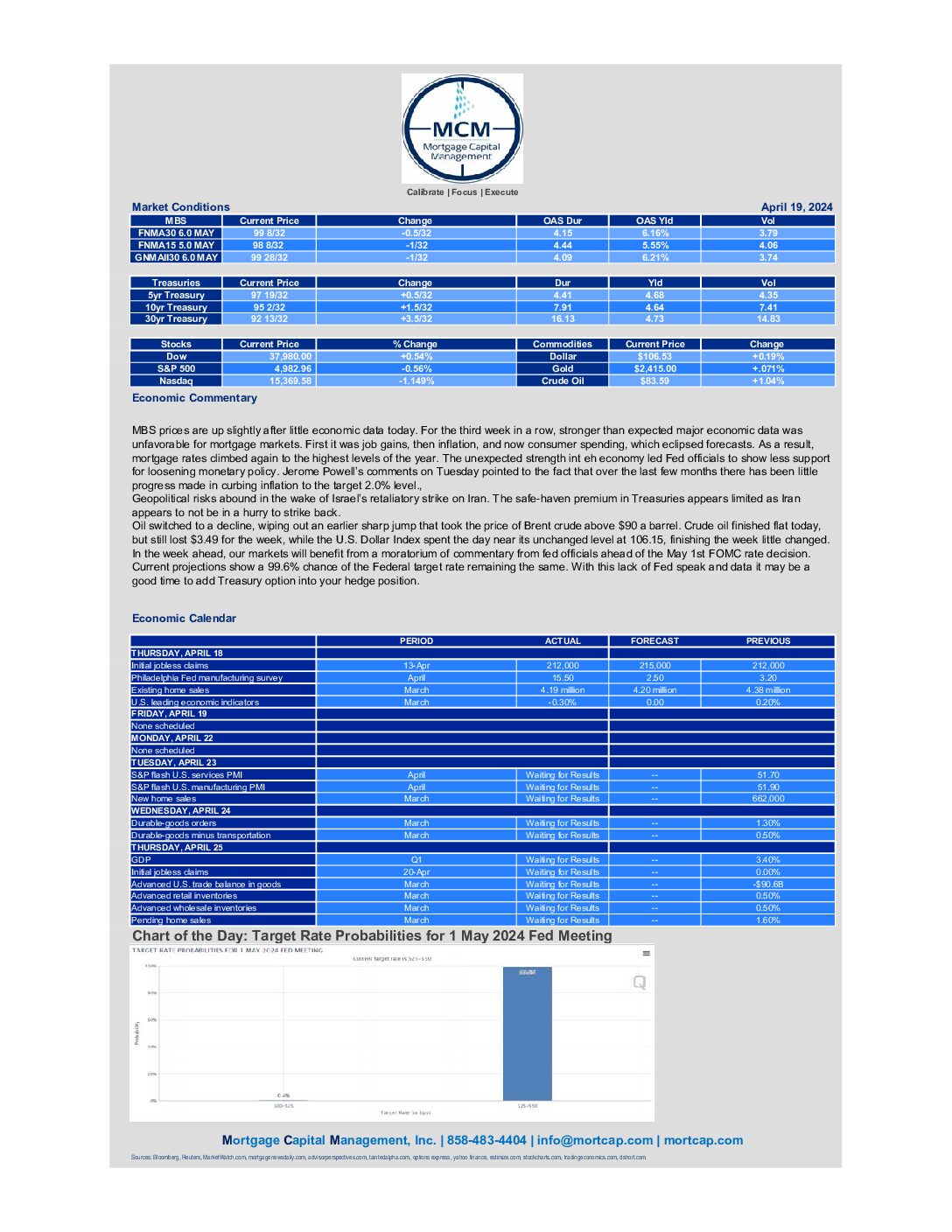

April 19th Market Commentary

MBS prices are up slightly after little economic data today. For the third week in a row, stronger than expected major economic data was unfavorable for mortgage markets. First it was job gains, then inflation, and now consumer spending, which eclipsed forecasts. As a result, mortgage rates climbed again to the highest

April 18th Market Commentary

MBS prices are down about 9/32 this morning while the DOW is down about 15 points as investors braced for Netflix to kick earnings season into high gear. Stocks have struggled amid concerns inflation is no longer cooling and the Federal Reserve could ease back on interest rate cuts.

April 17th Market Commentary

MBS prices are up about 9/32 this morning while the DOW is down about 100 points as investors interest rate worries coincide with a fresh slate of corporate earnings. Stocks have struggled to reprise their early-year rally, buffeted most recently by worries over heightened tensions in the Middle East

April 16th Market Commentary

MBS prices are down about 6/32 this morning while the DOW is up about 200 points. The moves come as bond yields remain at multi-month highs, coupled with rising tensions in the Middle East following Iran's weekend attacks on Israel. After the 10-year Treasury yield touched 2024 highs

April 15th Market Commentary

MBS prices are down about 13/32 this morning while the DOW is up about 160 points as yields on benchmark U.S. 10-year Treasuries jumped to their highest level since November on Monday after stronger-than-expected retail sales data from March suggested the Federal Reserve could delay cutting interest rates this year.

April 12th Market Commentary

MBS prices are up about 7/32 this morning while the DOW is down about 385 points as techs lost their winning ways, and as investors reeled from the banking sector's mixed results to kick off earnings season. Investors are scrutinizing quarterly results from Wall Street's big banks to assess