First Look Market Commentary

April 26th Market Commentary

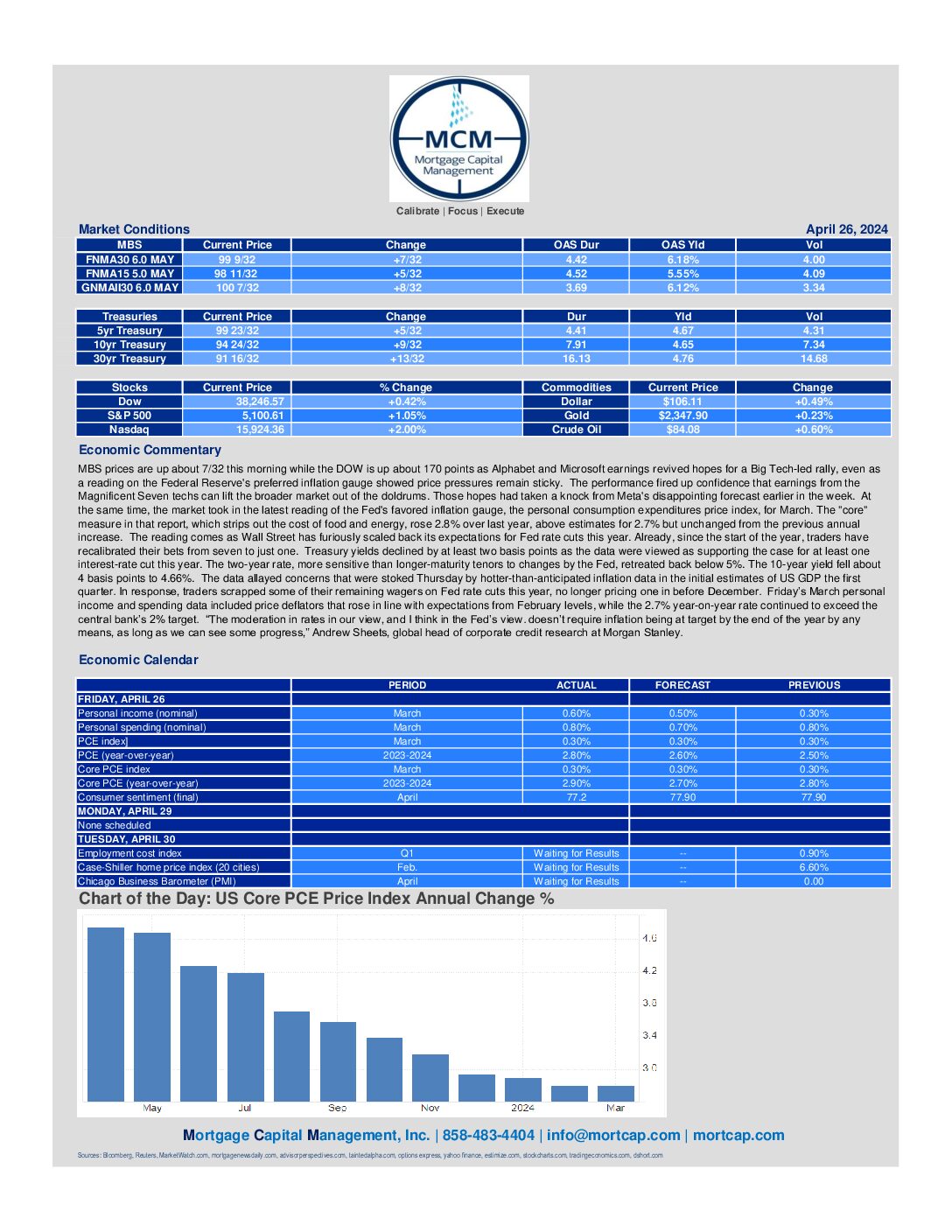

MBS prices are up about 7/32 this morning while the DOW is up about 170 points as Alphabet and Microsoft earnings revived hopes for a Big Tech-led rally, even as a reading on the Federal Reserve’s preferred inflation gauge showed price pressures remain sticky. Treasury yields declined by at least two basis points as the data were viewed as supporting the case for at least one interest-rate cut this year. The two-year rate, more sensitive than longer-maturity tenors to changes by the Fed, retreated back below 5%. The 10-year yield fell about 4 basis points to 4.66%.

April 24th Market Commentary

MBS prices are down about 7/32 this morning while the DOW is down about 130 points as the ten year treasury yield rose 1.17% to 4.65. Mortgage applications in the US fell by 2.7% from the previous week in the period ending April 19th, trimming the 3.3% increase from halfway through the month to mark the sharpest weekly decline since early February, according to data compiled by the MBA. Today’s economic reports showed that durable goods orders in the US rose 2.6%, or $7.3 billion.

April 23rd Market Commentary

MBS prices are up about 5/32 this morning while the DOW is up about 265 points as treasury yields are modestly lower to start the day, with the 10-year yield ticking down to around 4.59%, while the 2-year yield is hovering just below the 5% mark. Today’s economic reports showed that the March release for new home sales from the Census Bureau came in at a seasonally adjusted annual rate of 693,000 units, its fastest pace in six months and higher than the 668,000 forecast. New home sales were up 8.8% month-over-month from a revised rate of 637,000 in February and are up 8.3% from one year ago.

April 22nd Market Commentary

MBS prices are up about 3/32 this morning while the DOW is up about 140 points as investors braced for a flood of corporate earnings. After its recent battering, the market rally has sunk to its most fragile point in months, and this week will be critical to determining whether the malaise continues. Tech stocks are looking to recover after lackluster earnings from Netflix dragged on a broader market already grappling with geopolitical tensions. Fading chances of an interest rate cut have fueled skepticism that megacaps can continue to shoulder the task of driving gains. Meanwhile, the debate over the Federal Reserve’s stance on rate cuts continued to rumble after Chair Jerome Powell and fellow policymakers turned more hawkish last week in the face of persistent inflation.

April 19th Market Commentary

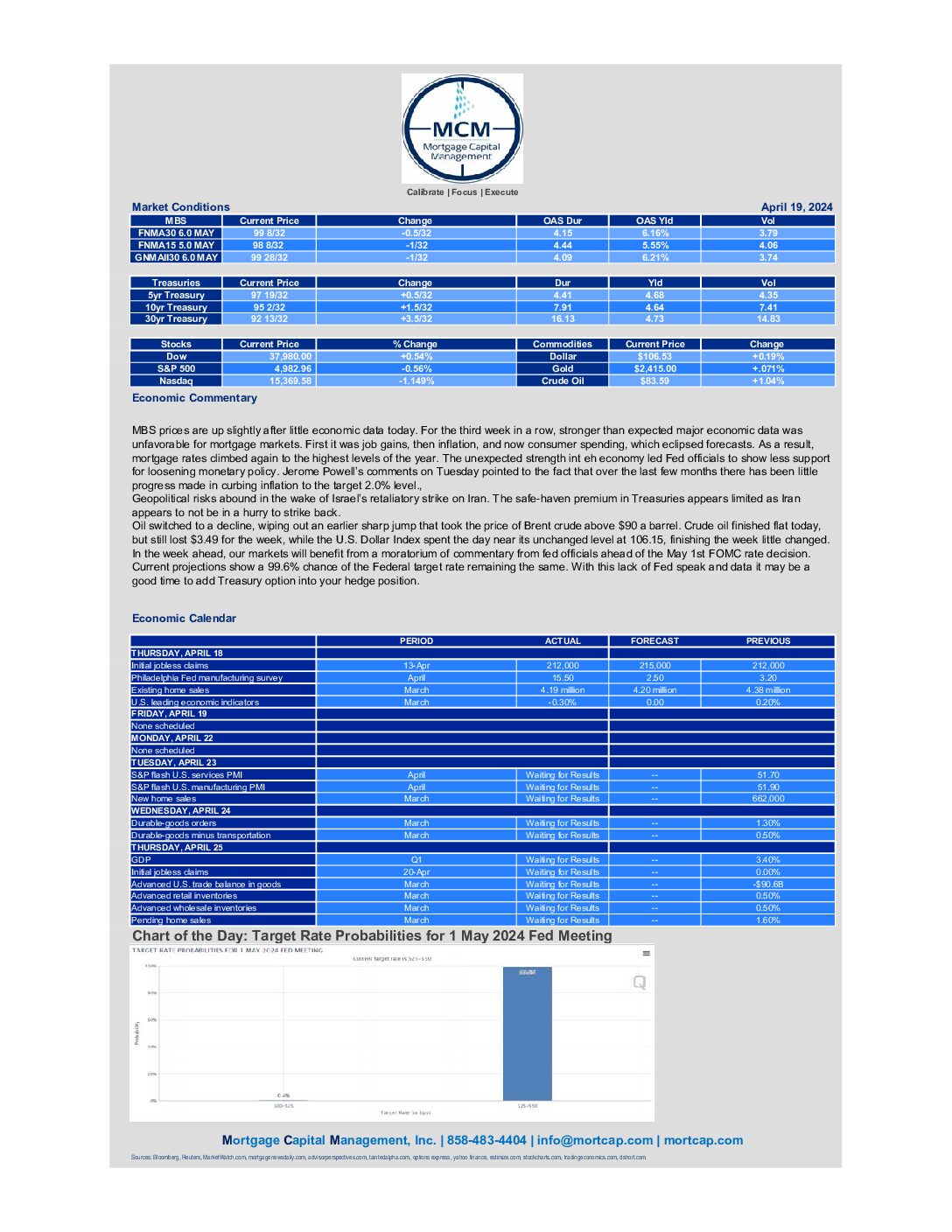

MBS prices are up slightly after little economic data today. For the third week in a row, stronger than expected major economic data was

unfavorable for mortgage markets. First it was job gains, then inflation, and now consumer spending, which eclipsed forecasts. As a result,

mortgage rates climbed again to the highest levels of the year. The unexpected strength int eh economy led Fed officials to show less support

for loosening monetary policy. Jerome Powell’s comments on Tuesday pointed to the fact that over the last few months there has been little

progress made in curbing inflation to the target 2.0% level.