First Look Market Commentary

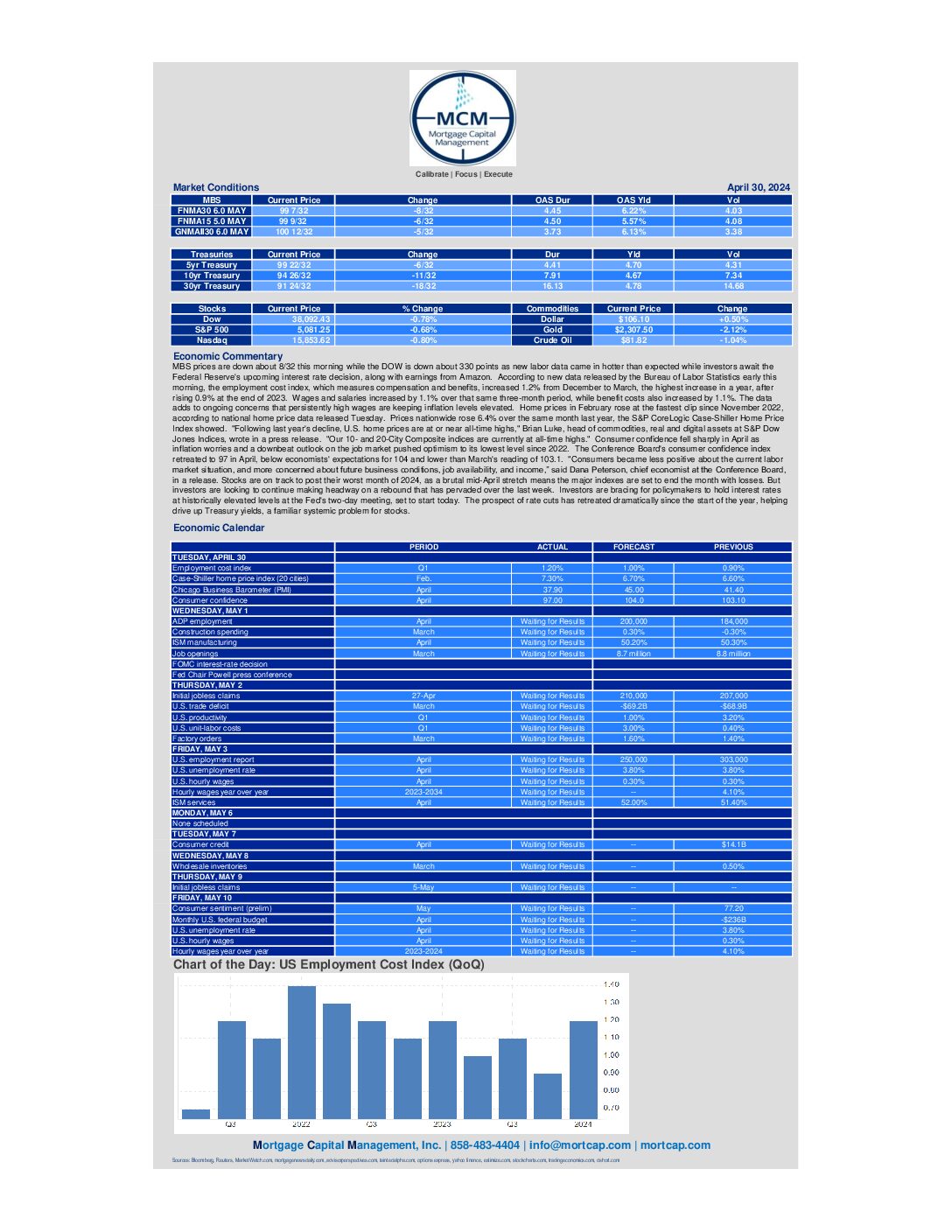

April 30th Market Commentary

MBS prices are down about 8/32 this morning while the DOW is down about 330 points as new labor data came in hotter than expected while investors await the Federal Reserve’s upcoming interest rate decision, along with earnings from Amazon. Investors are bracing for policymakers to hold interest rates at historically elevated levels at the Fed’s two-day meeting, set to start today. The prospect of rate cuts has retreated dramatically since the start of the year, helping drive up Treasury yields, a familiar systemic problem for stocks.

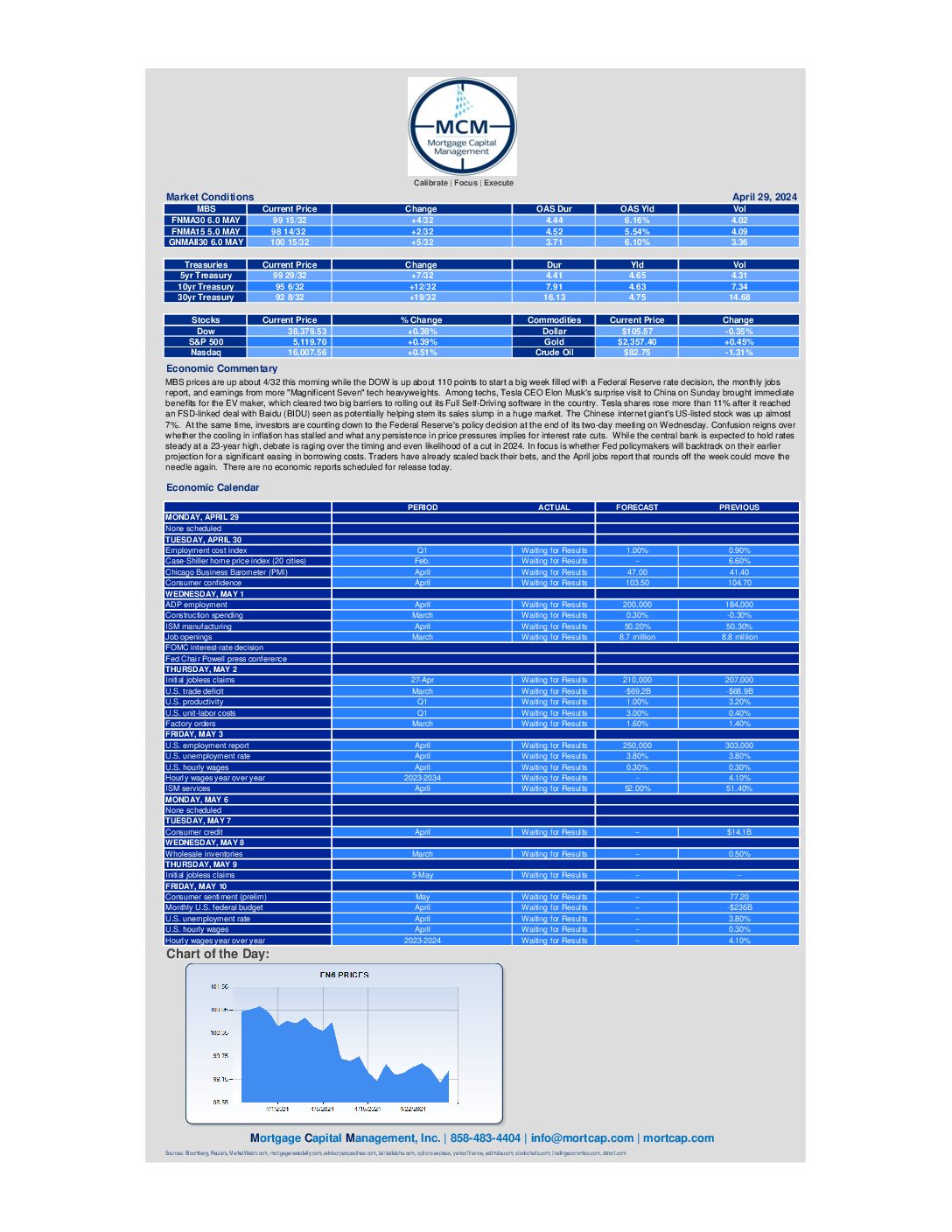

April 29th Market Commentary

MBS prices are up about 4/32 this morning while the DOW is up about 110 points to start a big week filled with a Federal Reserve rate decision, the monthly jobs report, and earnings from more “Magnificent Seven” tech heavyweights. In focus is whether Fed policymakers will backtrack on their earlier projection for a significant easing in borrowing costs. Traders have already scaled back their bets, and the April jobs report that rounds off the week could move the needle again. There are no economic reports scheduled for release today.

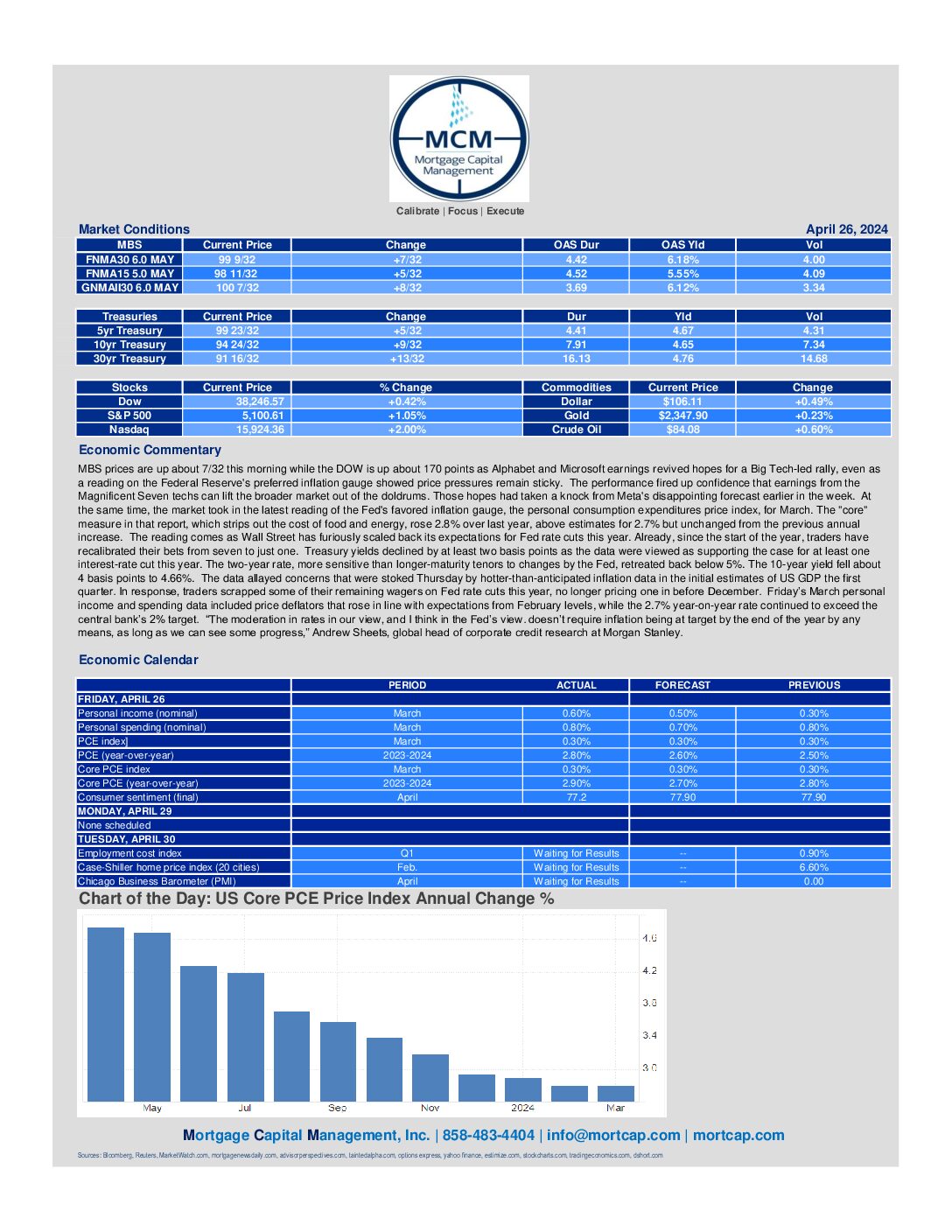

April 26th Market Commentary

MBS prices are up about 7/32 this morning while the DOW is up about 170 points as Alphabet and Microsoft earnings revived hopes for a Big Tech-led rally, even as a reading on the Federal Reserve’s preferred inflation gauge showed price pressures remain sticky. Treasury yields declined by at least two basis points as the data were viewed as supporting the case for at least one interest-rate cut this year. The two-year rate, more sensitive than longer-maturity tenors to changes by the Fed, retreated back below 5%. The 10-year yield fell about 4 basis points to 4.66%.

April 24th Market Commentary

MBS prices are down about 7/32 this morning while the DOW is down about 130 points as the ten year treasury yield rose 1.17% to 4.65. Mortgage applications in the US fell by 2.7% from the previous week in the period ending April 19th, trimming the 3.3% increase from halfway through the month to mark the sharpest weekly decline since early February, according to data compiled by the MBA. Today’s economic reports showed that durable goods orders in the US rose 2.6%, or $7.3 billion.

April 23rd Market Commentary

MBS prices are up about 5/32 this morning while the DOW is up about 265 points as treasury yields are modestly lower to start the day, with the 10-year yield ticking down to around 4.59%, while the 2-year yield is hovering just below the 5% mark. Today’s economic reports showed that the March release for new home sales from the Census Bureau came in at a seasonally adjusted annual rate of 693,000 units, its fastest pace in six months and higher than the 668,000 forecast. New home sales were up 8.8% month-over-month from a revised rate of 637,000 in February and are up 8.3% from one year ago.