First Look Market Commentary

May 3rd Market Commentary

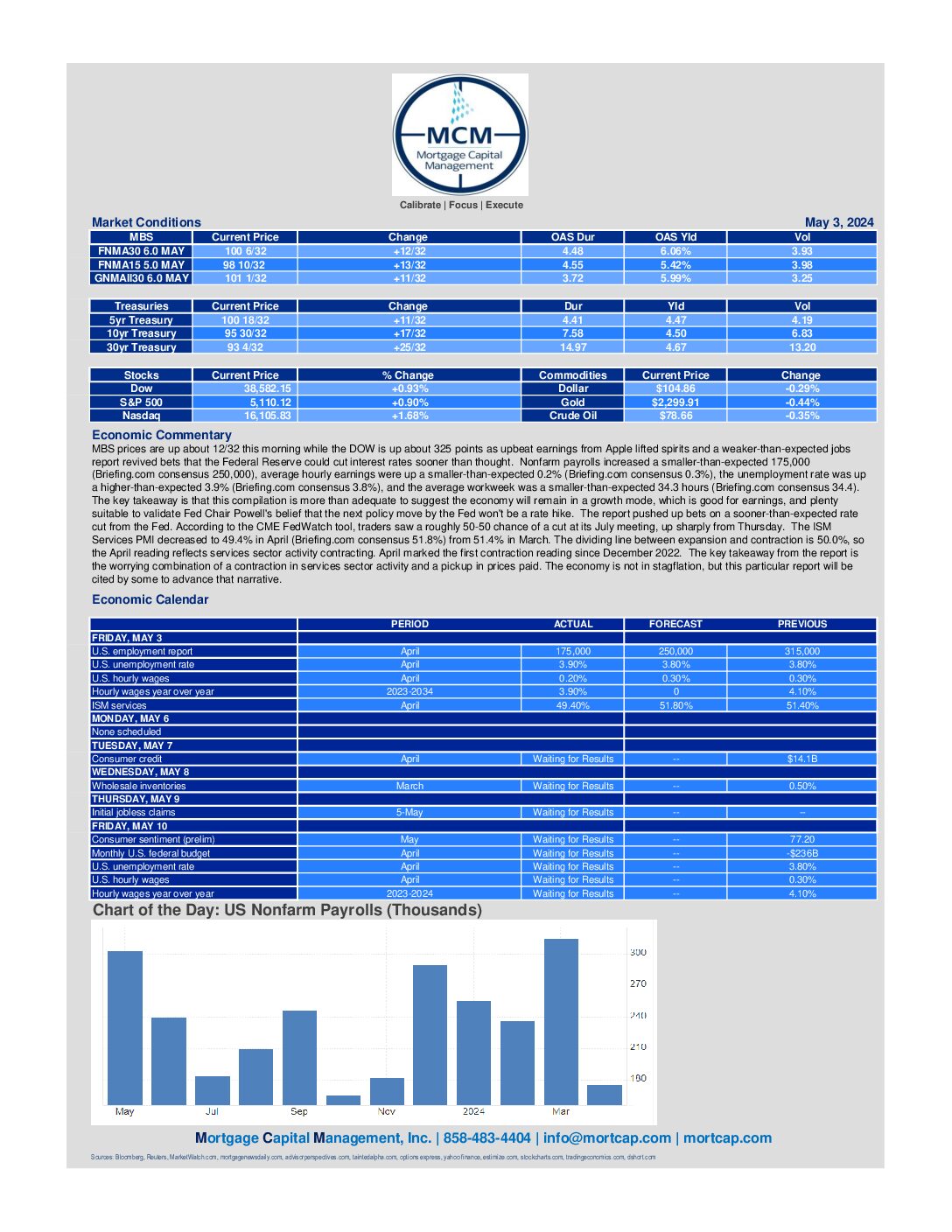

MBS prices are up about 12/32 this morning while the DOW is up about 325 points as upbeat earnings from Apple lifted spirits and a weaker-than-expected jobs report revived bets that the Federal Reserve could cut interest rates sooner than thought. Nonfarm payrolls increased a smaller-than-expected 175,000 (Briefing.com consensus 250,000). According to the CME FedWatch tool, traders saw a roughly 50-50 chance of a cut at its July meeting, up sharply from Thursday.

May 2nd Market Commentary

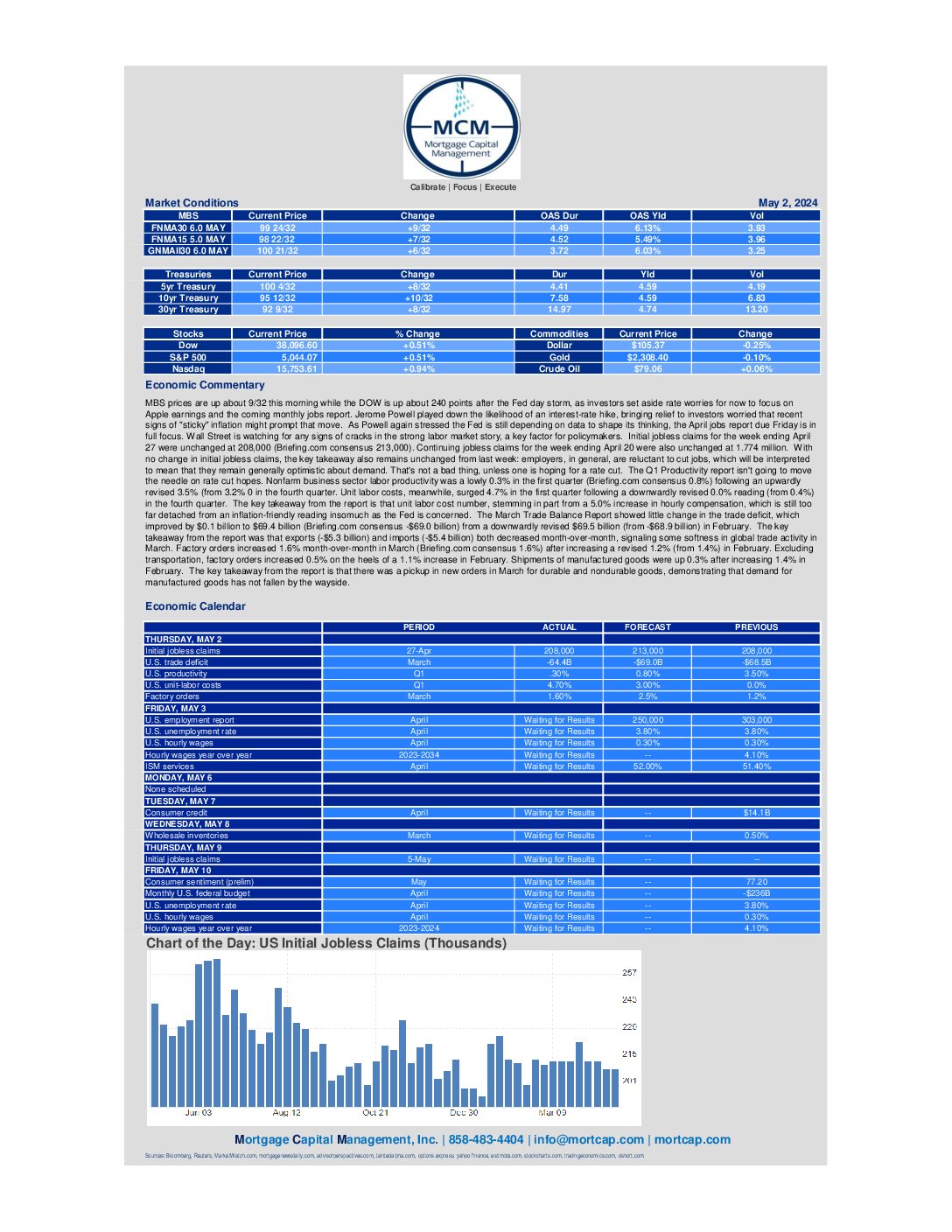

BS prices are up about 9/32 this morning while the DOW is up about 240 points after the Fed day storm, as investors set aside rate worries for now to focus on Apple earnings and the coming monthly jobs report. Jerome Powell played down the likelihood of an interest-rate hike, bringing relief to investors worried that recent signs of “sticky” inflation might prompt that move. As Powell again stressed the Fed is still depending on data to shape its thinking, the April jobs report due Friday is in full focus.

May 1st Market Commentary

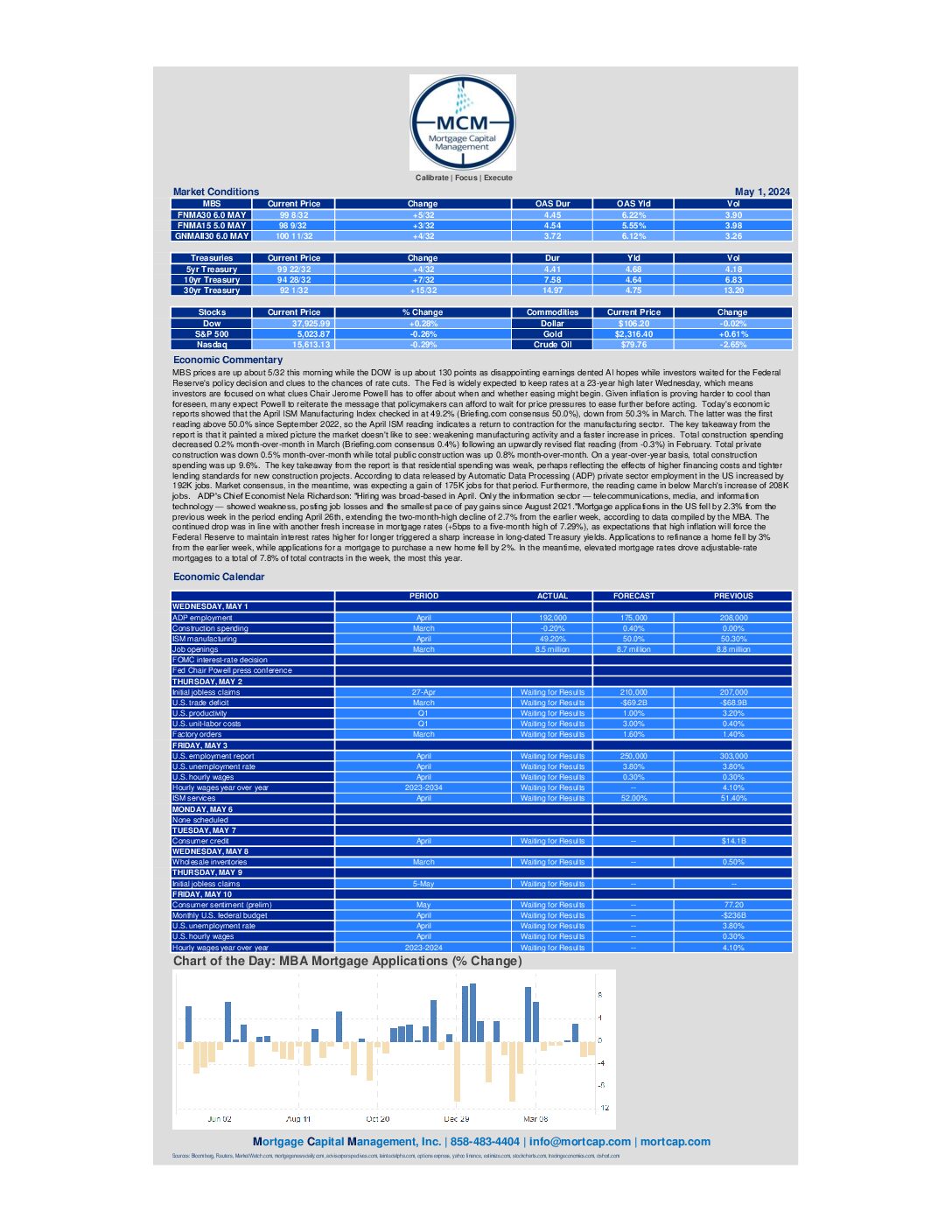

MBS prices are up about 5/32 this morning while the DOW is up about 130 points as disappointing earnings dented AI hopes while investors waited for the Federal Reserve’s policy decision and clues to the chances of rate cuts. The Fed is widely expected to keep rates at a 23-year high later Wednesday, which means investors are focused on what clues Chair Jerome Powell has to offer about when and whether easing might begin.

April 30th Market Commentary

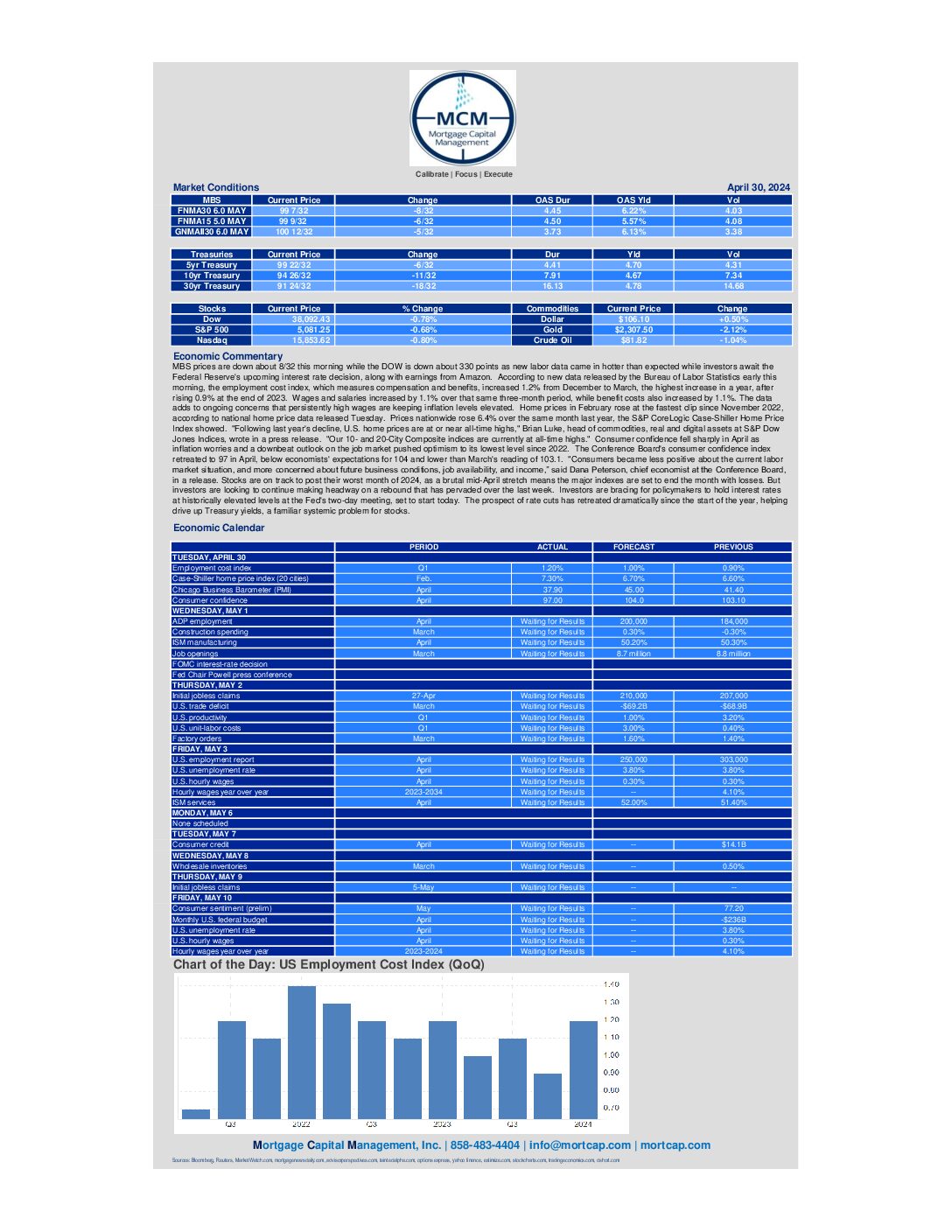

MBS prices are down about 8/32 this morning while the DOW is down about 330 points as new labor data came in hotter than expected while investors await the Federal Reserve’s upcoming interest rate decision, along with earnings from Amazon. Investors are bracing for policymakers to hold interest rates at historically elevated levels at the Fed’s two-day meeting, set to start today. The prospect of rate cuts has retreated dramatically since the start of the year, helping drive up Treasury yields, a familiar systemic problem for stocks.

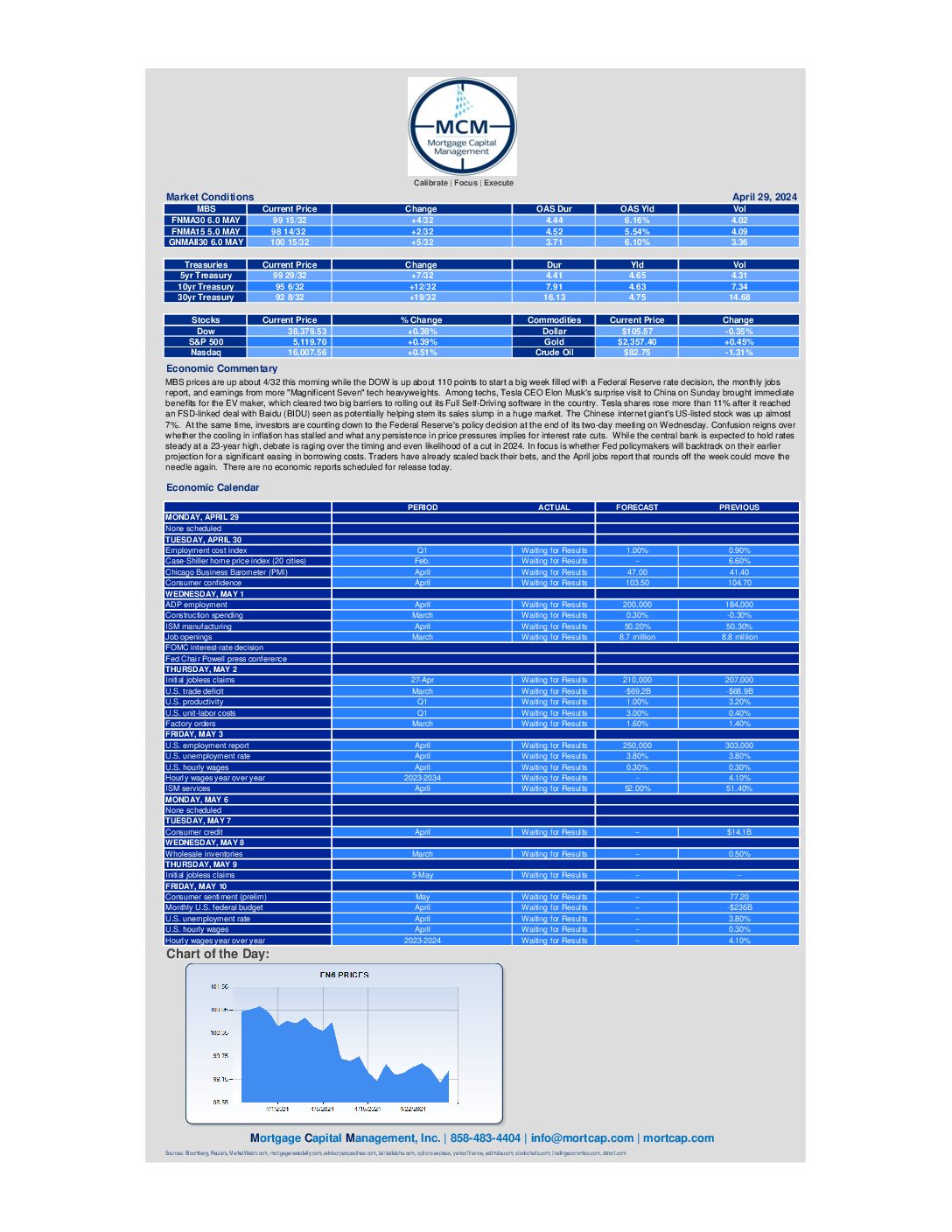

April 29th Market Commentary

MBS prices are up about 4/32 this morning while the DOW is up about 110 points to start a big week filled with a Federal Reserve rate decision, the monthly jobs report, and earnings from more “Magnificent Seven” tech heavyweights. In focus is whether Fed policymakers will backtrack on their earlier projection for a significant easing in borrowing costs. Traders have already scaled back their bets, and the April jobs report that rounds off the week could move the needle again. There are no economic reports scheduled for release today.