CME 5-year Swap Futures Contract

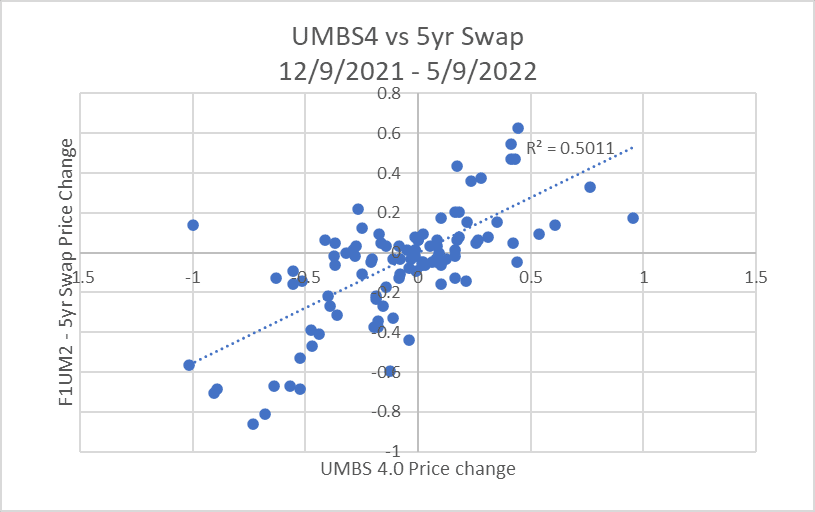

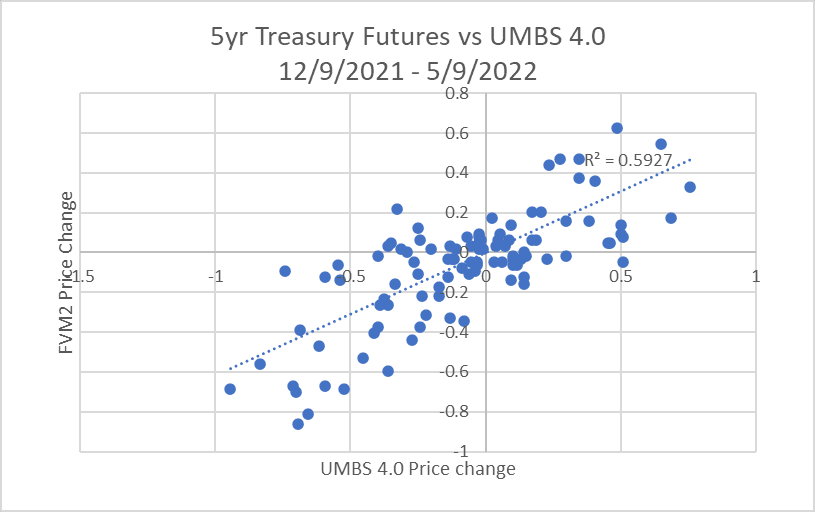

Based on closing data for the past 6 months, the 5 yr. swap futures contract has tracked the price for UMBS 4.0 on average very well. However, they are very different instruments and basis risk may surprise those who rely too heavily on this relationship especially in the short run.

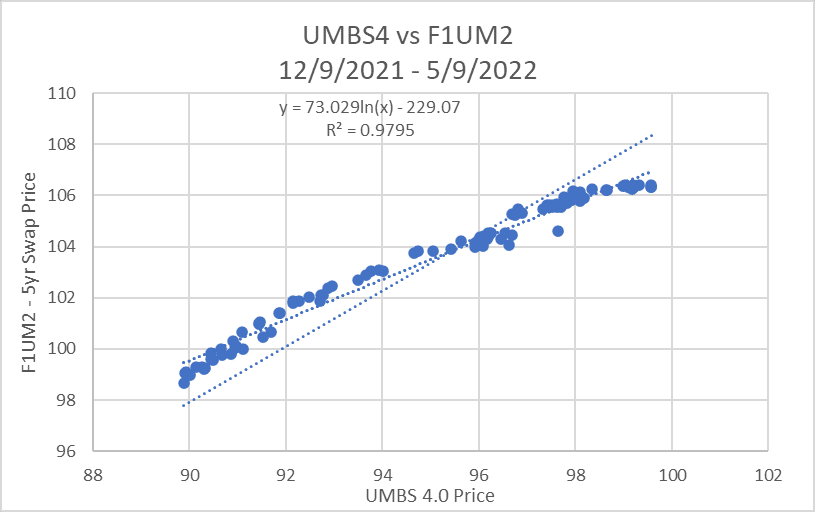

Based on closing data for the past 6 months, the 5 yr. swap futures contract has tracked the price for UMBS 4.0 on average very well. However, they are very different instruments and basis risk may surprise those who rely too heavily on this relationship especially in the short run – see middle graph below. Rolls on the 5 yr. swap are much lower than the UMBS 4.0 which is why you may want to consider using the 5 yr. swap. Here is a graph of the data:

Copyright 2022 Mortgage Capital Management, Inc.