Mortgage Banking Decision Science

AI has many applications in the mortgage industry and too many to mention in this short blog. Many companies have significant amounts of data from previous borrower transactions and in pipeline data from potential borrowers. The required types of data and the storage of data is different for different parts of your company. For example, Loan Originators will want a subset of data providing likely refinance business from a book of business done between a certain timeframe and rate level. Servicers will need to track late payments, costs, and foreclosure activity and value on each property amongst many other items. Capital Markets managers also, have their own unique needs when it comes to data base fields and availability, however, the data needs to be stored, like in other departments, in a way that is easily accessible, accurate, and reflects the data needed for decision making. For example, the LifeCycleDB by MCM provides information about how long each loan took to progress through the pipeline. For example, how many days it took to be processed, get approval, draw documents etc…. This information is vital as most secondary market managers will agree that a loan that falls out of the pipeline due to borrower cancelation or non-approval, within a couple of days is much better than those that fallout on the last day of the lock period. MCM not only has the data required in the database to quantify this, but also the science of managing the data in a way that helps our AI tools decipher what it costs from a fallout standpoint between loans that fallout right away versus ones that take additional time in the pipeline. This is but just one example of the many different fields and types of data needed by capital markets.

MCM has developed such a database and analytical system for capital markets professionals for each of its current customers. The system is called LifecycleDB and includes information about every loan that a customer locks and all changes made throughout the pipeline life cycle. Items included: market conditions, TBA levels, loan level pricing, the amount of time each loan took to process, stages of the cycle and many other factors. This data is the key to unlocking the power of Predictive AI and has been incorporated in MCM’s Pipeline Risk Management system – “Hedge Commander.”

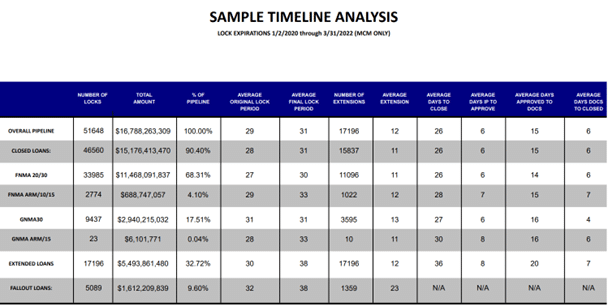

Below is a sample report from the LifeCycleDB showing average days to process loans by type with extensions:

For more information about MCM’s AI technology and database applications please do not hesitate to email us or call!

Who you have developing decision systems, especially AI based ones, for your company matters a great deal! Just because someone is adept at using ChatGPT4 is not an indicator that they know your industry, your data, or how to derive the information needed to get great results.