First Look Market Commentary

May 8th Market Commentary

MBS prices are down about 3/32 this morning while the DOW is up about 85 points as investors tried to read the rate-cut runes and weighed a fresh batch of earnings reports for insight into the chance of a corporate America-spurred revival. Mortgage applications in the US rose by 2.6% from the previous week in the period ending May 3rd, recovering from the 2.3% decline in the earlier period and halting two consecutive weeks of sharp declines in mortgage demand, according to data from the MBA.

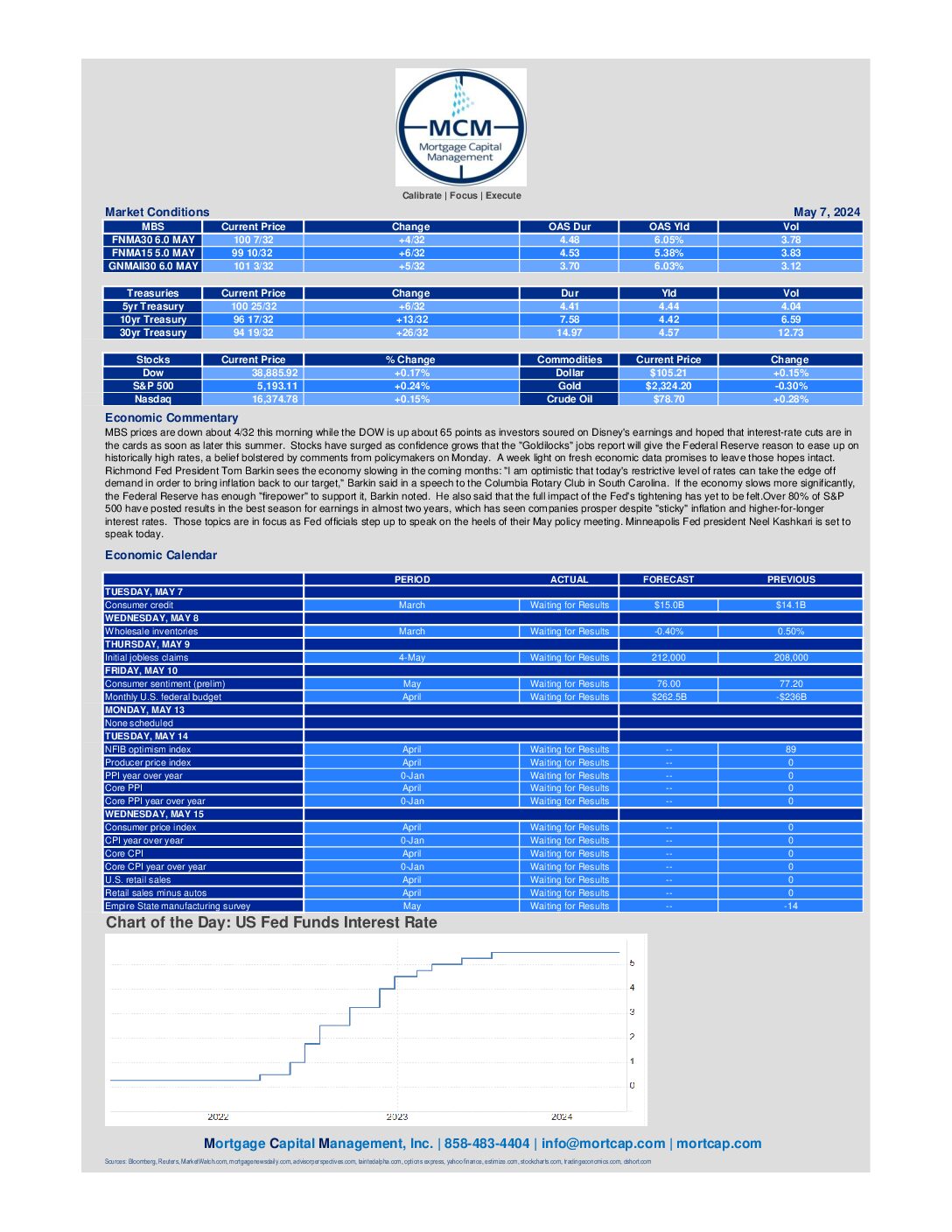

May 7th Market Commentary

MBS prices are down about 4/32 this morning while the DOW is up about 65 points as investors soured on Disney’s earnings and hoped that interest-rate cuts are in the cards as soon as later this summer. Richmond Fed President Tom Barkin sees the economy slowing in the coming months: “I am optimistic that today’s restrictive level of rates can take the edge off demand in order to bring inflation back to our target,” Barkin said in a speech to the Columbia Rotary Club in South Carolina. If the economy slows more significantly, the Federal Reserve has enough “firepower” to support it, Barkin noted.

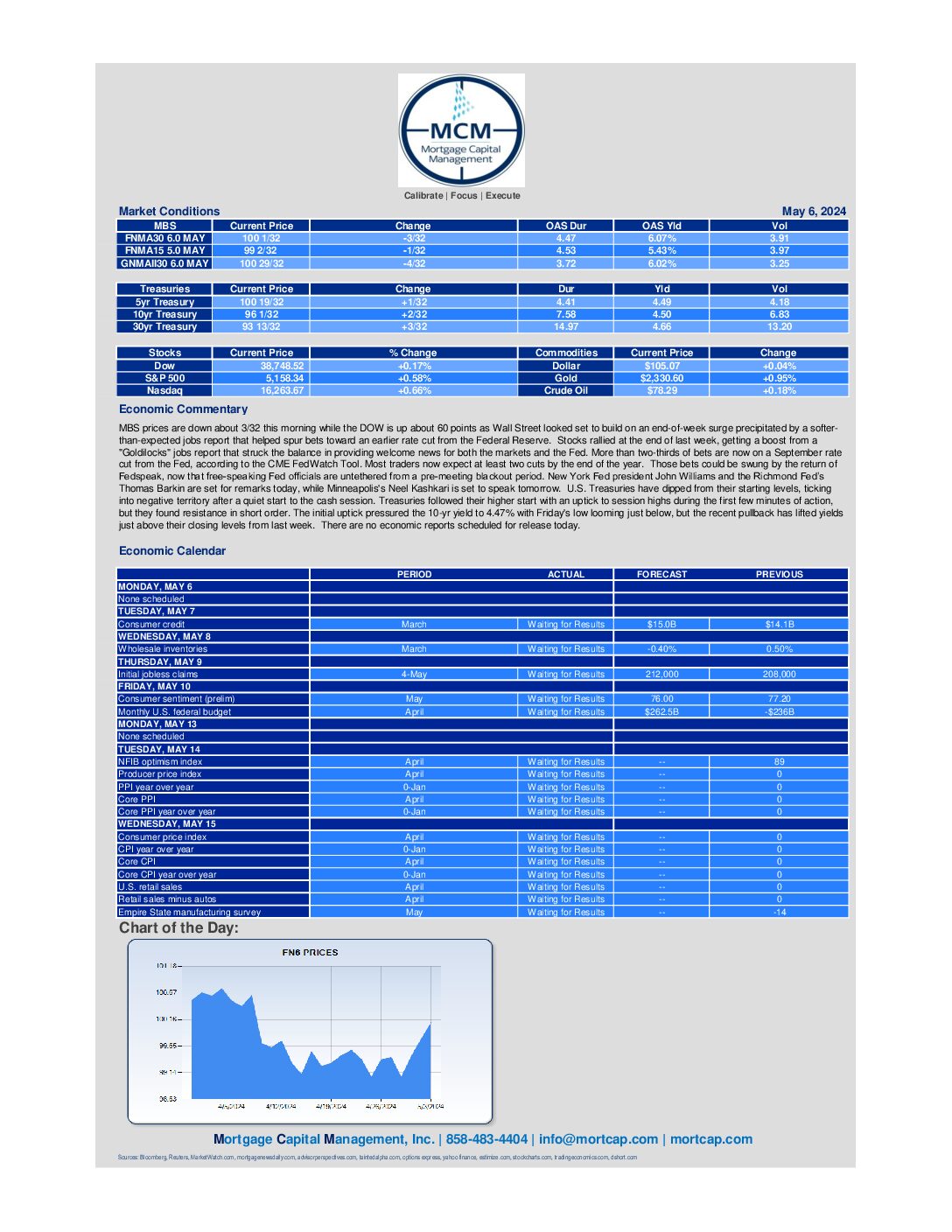

May 6th Market Commentary

MBS prices are down about 3/32 this morning while the DOW is up about 60 points as Wall Street looked set to build on an end-of-week surge precipitated by a softer-than-expected jobs report that helped spur bets toward an earlier rate cut from the Federal Reserve. More than two-thirds of bets are now on a September rate cut from the Fed, according to the CME FedWatch Tool. Most traders now expect at least two cuts by the end of the year. Those bets could be swung by the return of Fedspeak, now that free-speaking Fed officials are untethered from a pre-meeting blackout period.

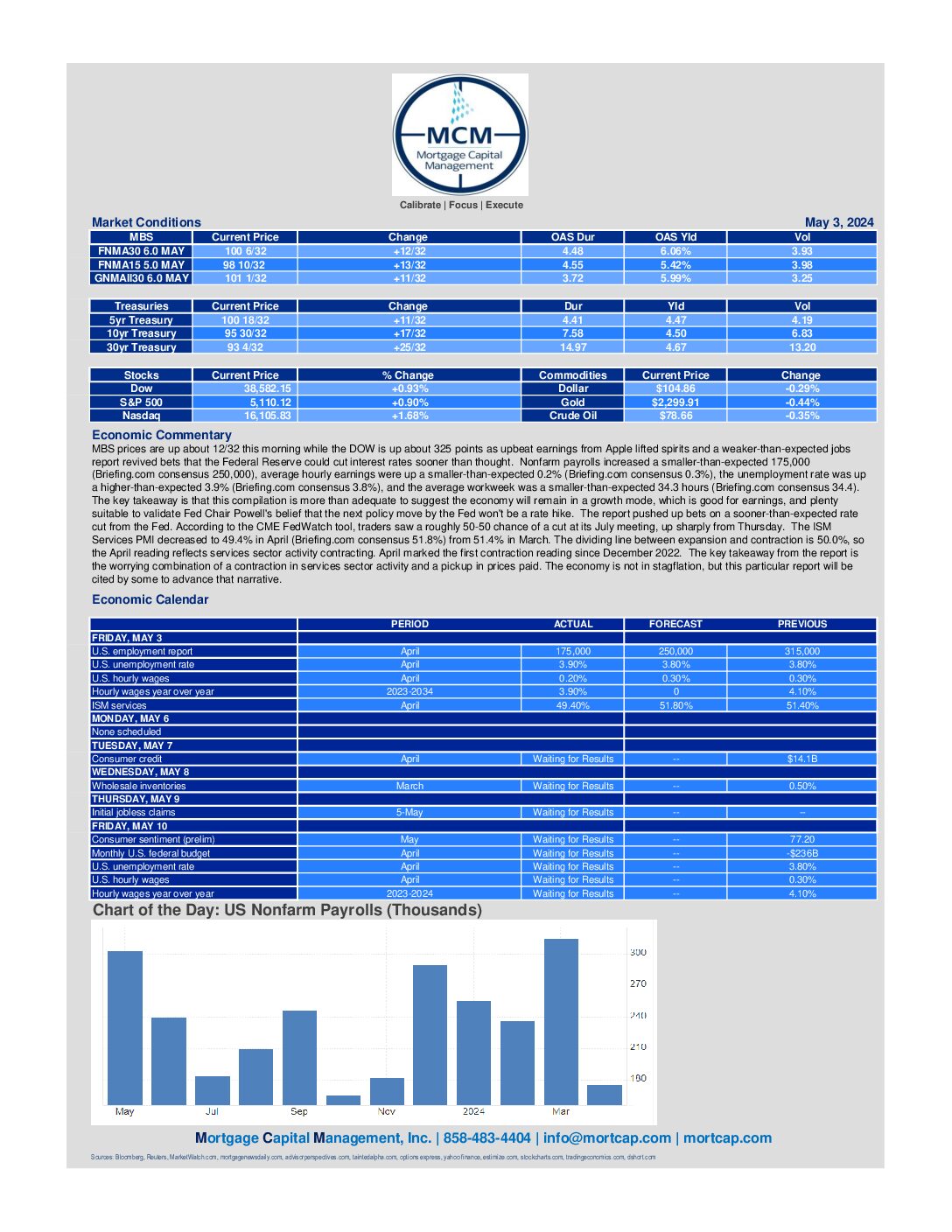

May 3rd Market Commentary

MBS prices are up about 12/32 this morning while the DOW is up about 325 points as upbeat earnings from Apple lifted spirits and a weaker-than-expected jobs report revived bets that the Federal Reserve could cut interest rates sooner than thought. Nonfarm payrolls increased a smaller-than-expected 175,000 (Briefing.com consensus 250,000). According to the CME FedWatch tool, traders saw a roughly 50-50 chance of a cut at its July meeting, up sharply from Thursday.

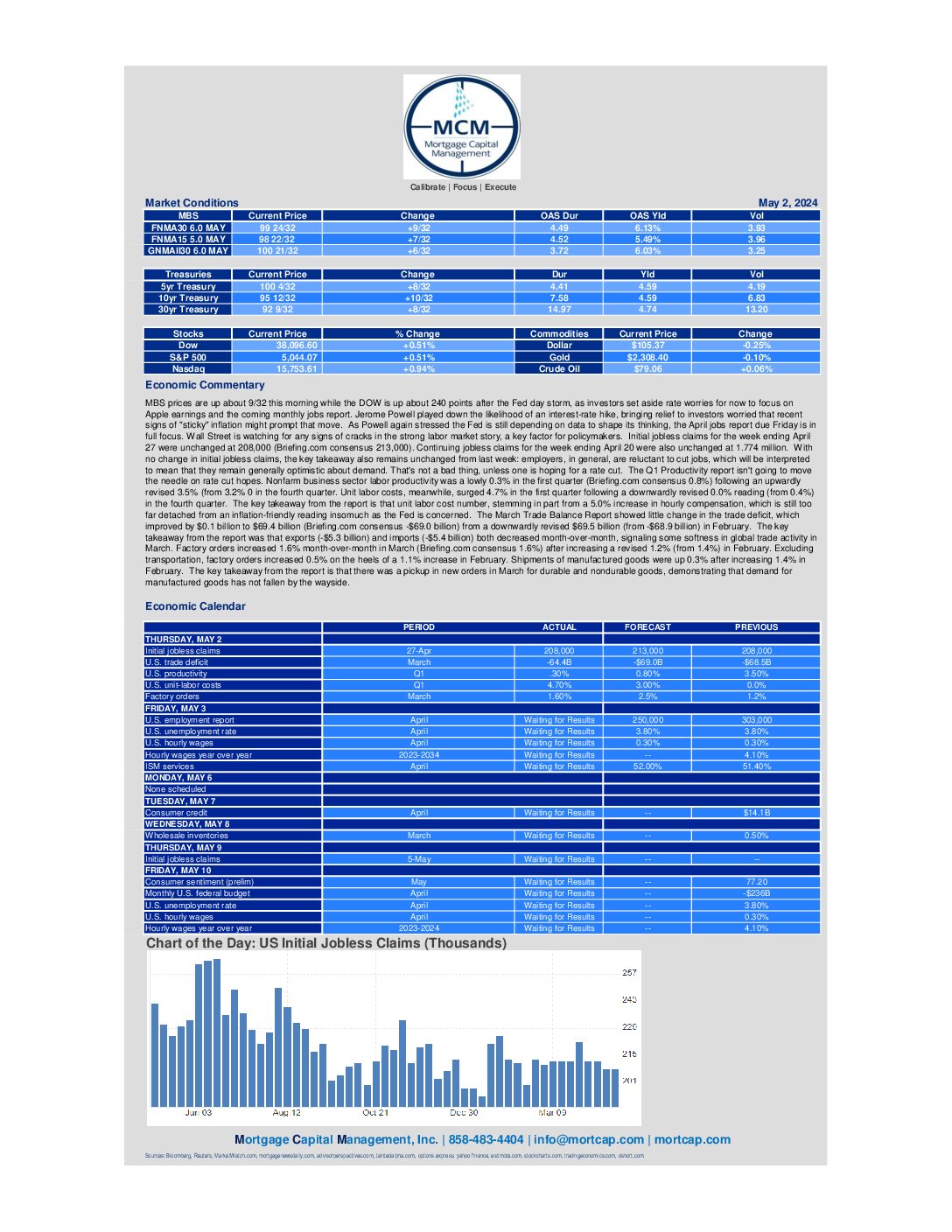

May 2nd Market Commentary

BS prices are up about 9/32 this morning while the DOW is up about 240 points after the Fed day storm, as investors set aside rate worries for now to focus on Apple earnings and the coming monthly jobs report. Jerome Powell played down the likelihood of an interest-rate hike, bringing relief to investors worried that recent signs of “sticky” inflation might prompt that move. As Powell again stressed the Fed is still depending on data to shape its thinking, the April jobs report due Friday is in full focus.